Your Guide on How to Break Into Investment Banking

Trying to break into investment banking is a marathon, not a sprint. It's a demanding path, but thankfully, it's also a pretty well-defined process. This isn't about getting lucky—it's about methodically building a profile that banks can't ignore.

Your journey will be packed with late nights learning valuation models, countless networking calls that feel like mini-interviews, and prep sessions that push you to your limit.

Your Realistic Roadmap to a Career in Investment Banking

Let's get one thing straight: investment bankers are more than just spreadsheet wizards. They're strategic advisors who guide massive companies through game-changing events—think mergers and acquisitions (M&A), initial public offerings (IPOs), and raising billions in capital for global expansion. The work is intense, analytical, and comes with a ton of responsibility.

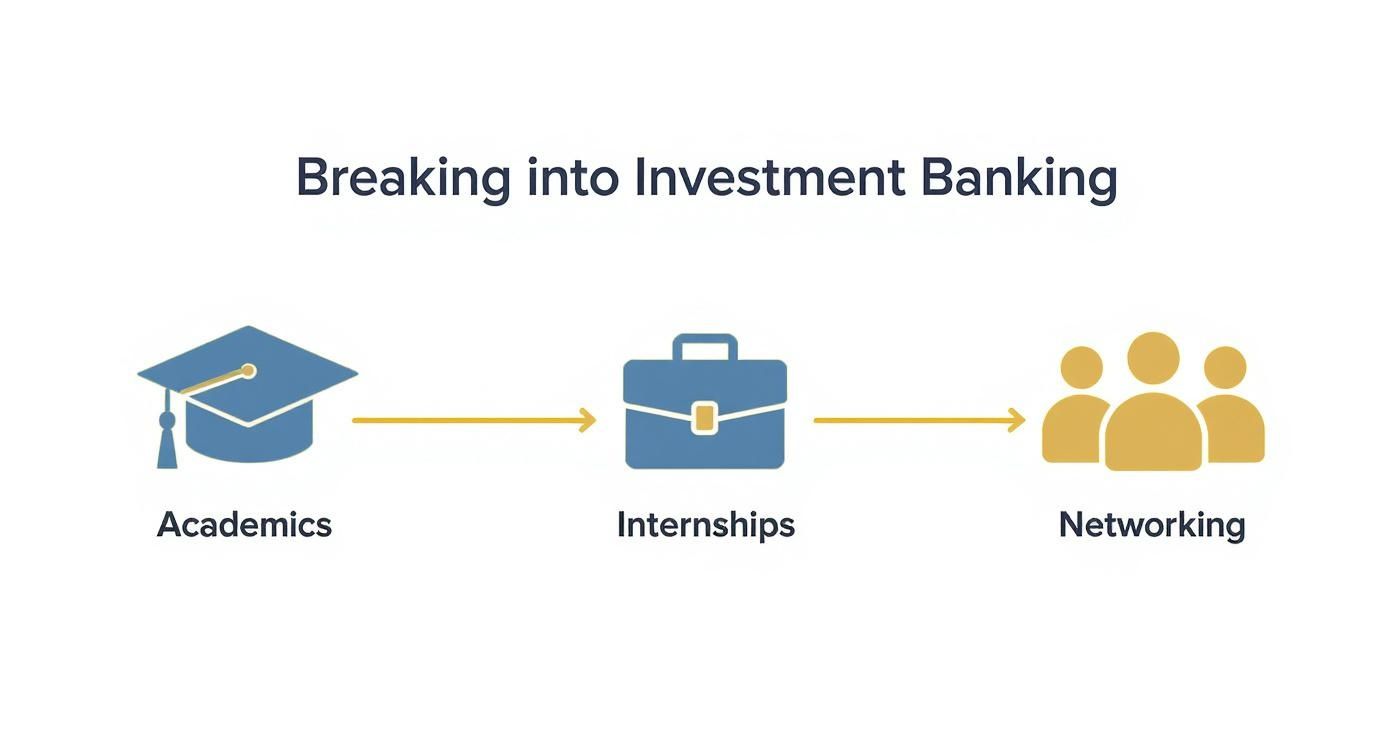

To even get a foot in the door, you have to build a compelling case for yourself across four key areas. Dropping the ball on any one of them can unfortunately derail your chances pretty quickly.

Before we dive into the specifics, let's establish the foundational pillars that will support your entire recruiting effort. These are the non-negotiables—the core components every successful candidate must master.

To make it simple, I've broken them down into a table. Think of this as your high-level checklist for the entire process.

The Four Pillars of Breaking Into Investment Banking

Pillar | Key Objective | Critical Action Items |

|---|---|---|

Academics & Extracurriculars | Prove you have the intellectual horsepower and a strong work ethic. | Maintain a high GPA (3.7+ is the unofficial cutoff). Take on leadership roles that show you can manage time, work in a team, and grind. |

Targeted Internships | Gain real-world finance experience and confirm your interest in the industry. | Secure internships in finance-adjacent fields like corporate finance, private equity, or wealth management. Each one is a stepping stone. |

Strategic Networking | Build genuine relationships to get insights, mentorship, and crucial referrals. | Connect with analysts and associates. Ask smart questions. Follow up thoughtfully. Your goal is to turn a cold resume into a warm intro. |

Technical & Behavioral Mastery | Absolutely nail your interviews by proving you have the skills and personality to thrive. | Master accounting, valuation (DCF, Comps), and M&A concepts. Prepare stories for behavioral questions that show you're resilient and a team player. |

Getting these four pillars right is the entire game. As you can see, they're not separate steps but overlapping priorities you'll need to juggle throughout your time at university.

This process is a constant balancing act. You're building your academic credentials while simultaneously networking for next summer's internship. It never really stops.

Understanding the Career Path and Compensation

So, what's the reward for all this hard work? For undergrads, the most common entry point is the Analyst role, and the pay is a major draw.

Analysts at top banks can expect base salaries between $100,000 to $125,000. But the real kicker is the bonus, which can bring your total first-year compensation to anywhere from $160,000 to $210,000.

After grinding it out for two or three years, high-performing analysts often get promoted to the Associate level. That’s a significant jump, with total pay packages ranging from $275,000 to $475,000. If you're curious about the long-term potential, it’s worth taking a closer look at investment banking salaries and career progression.

Crafting a Resume That Gets You the Interview

Let's get one thing straight: your resume isn't a history of your past jobs. It's a marketing document, and its only job is to survive a brutal six-second scan and land in the "yes" pile. Bankers at top firms are buried under thousands of applications. Yours needs to be clean, powerful, and instantly signal that you're worth talking to.

The golden rule here is one page, no exceptions. That single page has to tell a killer story about your ambition, analytical skills, and sheer grit. Every word, every bullet point, has to fight for its place.

The Foundation: A Clean and Standard Format

Now is not the time for flashy designs or creative layouts. Investment banking is a world of tradition and brutal efficiency. Your resume needs to look exactly how a banker expects it to look, letting them find what they need in a split second.

Structure: Follow the classic flow: Education, Work Experience, Leadership & Activities, then Skills & Interests. Don't deviate. This is what they know and what they want to see.

Font: Stick with something professional and easy to read like Times New Roman or Garamond. Keep it at a 10-11 point size.

Margins: Go narrow—around 0.5 to 0.75 inches. This gives you maximum real estate without making the page feel cluttered.

This isn't about being boring; it's about showing you get it. You understand the culture. A sloppy or weirdly formatted resume is a huge red flag that you haven't done your homework, and it's an easy way to get tossed.

Quantify Everything: Turn Actions into Achievements

This is the single most important fix you can make. Bankers live and breathe numbers, so your resume needs to speak their language. Don't just list what you did; show what you accomplished. Frame every bullet point around the result.

Instead of saying you "Analyzed sales data for a team project," you need to reframe it with impact. Something like this is way stronger: "Analyzed 3 years of sales data for a regional retailer, identifying key trends that informed a new marketing strategy projected to increase customer retention by 15%."

Pro Tip: You can quantify anything. If you were a barista, you didn't just "make coffee." You "Managed over $2,000 in daily cash transactions with 100% accuracy and contributed to a 10% increase in store revenue through effective upselling techniques."

This proves you’re results-oriented, a non-negotiable trait for anyone serious about how to break into investment banking.

Translating Non-Finance Experience

Plenty of people break in from non-target schools or backgrounds completely unrelated to finance. It is absolutely not a dealbreaker, but you have to be smart about translating your experience. Your job is to show a direct line between what you've done and the skills an analyst needs.

Here’s how you can reframe common experiences to sound like a future banker:

Academic Project: Don't just list the name of the project. Detail your contribution. "Led a 4-person team to develop a pricing model for a new software product, conducting market research across 5 competitor platforms and presenting our final recommendation to a panel of professors."

Leadership in a Club: Go way beyond "President of the Economics Club." Try this instead: "Managed an annual budget of $5,000 and grew student membership by 40% over one academic year by organizing 12 professional development events with industry speakers."

Part-Time Job: Whether you were in retail or tutoring, find the impact. "Tutored 15+ students in calculus, helping them improve their average grades from a B- to an A- through personalized weekly sessions."

Each one of these examples screams analytical ability, leadership, or a relentless work ethic—the holy trinity for an IB analyst. Your resume is your first shot to prove you've got the raw materials. Make it count.

Building Your Network the Right Way

Let's get one thing straight: in investment banking, your network isn't just a bonus—it's your most critical asset. The cold truth is that a referral can instantly rescue your resume from the slush pile and put it right on top.

But good networking isn't about spamming every banker on LinkedIn. It’s a methodical, genuine process. Your goal is to go from being a random name on a spreadsheet to a candidate someone is willing to put their own reputation on the line for. That requires a real strategy.

H3: Identifying Your Key Targets

First things first, you need a hit list of firms and the people inside them. Casting a wide net is fine, but doing it blindly is a complete waste of time. The easiest place to start is with alumni from your university who are already in banking. That shared connection, however small, is a warm lead and dramatically boosts your chances of getting a response.

Here are the tools you should be using to build that list:

LinkedIn Sales Navigator: Seriously, sign up for the free trial. The advanced filters let you slice and dice by university, company, title (Analyst, Associate), and city. It's the single best tool for this.

University Alumni Database: This is a goldmine. People in this database have opted in to help students like you, making them way more receptive to a cold email.

Company Websites: For smaller boutique firms, check out their team pages. They often list their professionals, and you can cross-reference their names on LinkedIn to find contact info.

And please, stay organized. A simple tracking spreadsheet is non-negotiable. Track their name, firm, title, contact details, outreach dates, and notes from your calls. You'll thank yourself later when you're juggling dozens of conversations.

H3: Crafting Outreach That Actually Works

Your initial message is your first impression. Make it count. It needs to be short, respectful, and crystal clear about what you want. Bankers are drowning in emails, so a long, rambling message is a one-way ticket to the trash folder.

A solid cold email has just three parts:

A quick, polite intro: State your name, university, and year.

The "ask": Request a brief 15-minute chat to learn from their experience. Be specific.

Make it easy for them: Suggest a few times or offer to work around their schedule completely.

Example Cold Email Subject: Student from [Your University] Interested in Investment Banking

"Hi [Name],

My name is [Your Name], and I'm a [Your Year] at [Your University] studying [Your Major]. I found your profile through the alumni network and was incredibly impressed by your career path to [Their Firm].

Would you have 15 minutes in the coming weeks for a brief call? I'd love to learn more about your experience in the [Their Group] group and hear any advice you have for someone hoping to break into investment banking.

Thank you for your time.

Best, [Your Name]"

This works because it's direct, shows you've done your homework, and respects their time. If you're coming from a less traditional background, our guide on how to network for investment banking roles as a non-target dives into more specific strategies.

Not all outreach is created equal. While a warm introduction is king, a well-crafted cold email can still be surprisingly effective if you're persistent.

Networking Outreach Effectiveness

Method | Typical Response Rate | Best For | Key Tip |

|---|---|---|---|

Warm Referral | 60-80% | Getting a guaranteed conversation with a key contact. | The absolute gold standard. Always leverage mutual connections. |

Alumni Database Email | 20-40% | Reaching contacts who are already open to helping. | Mention your shared university prominently in the subject line. |

Cold LinkedIn Message | 10-20% | Mass outreach when other warm channels are exhausted. | Keep it under 4 sentences. Get straight to the point. |

Cold Email | 5-15% | Reaching specific bankers not active on LinkedIn. | Use a clear, professional subject line to avoid the spam filter. |

The key takeaway? Focus your energy on the highest-probability channels first—warm intros and alumni outreach—before moving on to pure cold outreach.

H3: Running an Effective Informational Interview

So you got a call on the books. Great. Now the real work begins. This isn't just a friendly chat; it's a mini-interview where you're being evaluated on your curiosity, preparation, and personality.

Despite what you hear about a shrinking Wall Street, the industry is still hiring. The U.S. investment banking sector employed around 381,854 people in recent years, with a steady annual growth of 1.4%. The demand for new talent is there, especially in hubs like New York, which holds over 21% of all job postings. You can dig into more of these investment banking employment trends on ibisworld.com.

Your questions need to show you’ve done your homework.

Start broad: ask about their role and the firm's culture.

Get specific: ask about a recent deal their team worked on that you read about.

Make it personal: ask about their own journey into banking and what they’ve learned.

Look ahead: wrap up by asking for advice for someone in your shoes.

The single most important part of the call comes at the very end. Before you hang up, politely ask: "Is there anyone else on your team you think it would be helpful for me to speak with?" This question is how you turn one contact into a web of allies inside a firm.

And of course, always send a thank-you email within 12 hours. Reference something specific you talked about. It shows you were actually listening.

Preparing for Technical and Behavioral Interviews

Once you’ve networked your way into an interview slot, the real work begins. This is where you prove you have the technical chops and the personality to survive the job. The entire process is a pressure test designed to separate the candidates who just memorized the guides from those who have truly mastered the material.

Your prep needs to be split right down the middle. Technicals prove you can do the work on day one. Behaviorals prove the team can stand working with you for 100 hours a week. Both are equally important.

Mastering the Core Technical Concepts

Look, technical questions in banking interviews aren't designed to trick you. They're a sanity check. Interviewers just need to confirm you have a rock-solid grasp of accounting, valuation, and basic M&A concepts. You don’t need to be a grizzled VP, but you absolutely have to nail the fundamentals.

There are three pillars you must own:

Accounting Fundamentals: You have to know how the three financial statements link together. Be ready to walk someone through exactly what happens to the Income Statement, Balance Sheet, and Cash Flow Statement when Depreciation goes up by $10. It's a classic for a reason.

Valuation Methodologies: This is non-negotiable. You need to explain the mechanics of a Discounted Cash Flow (DCF) analysis, Public Comparables (Comps), and Precedent Transactions. More importantly, you need to know the pros and cons of each and when you’d use one over the other.

Merger & LBO Models: No one expects you to build a full-blown LBO model from scratch in a 30-minute interview. But you must understand the mechanics. Be prepared to explain accretion/dilution in an M&A deal or how a private equity sponsor actually makes money in a Leveraged Buyout.

The goal isn’t just memorizing definitions. It's about deep understanding. Any decent interviewer can instantly tell the difference between someone reciting a guide and someone who genuinely gets the concepts and can apply them on the fly.

This only comes with practice. Relentless, painful practice. For a structured way to drill these concepts until they're second nature, our guide on the most common investment banking technical questions is a great place to start. Repetition is the only way to build the muscle memory you need to answer perfectly under pressure.

Structuring Compelling Behavioral Answers

While technical skills get your foot in the door, behavioral answers are often what seal the deal. Banks are screening for a very specific set of traits: an insane work ethic, humility, an obsession with detail, and the ability to function in a high-stress team. Your job is to tell stories that prove you have these qualities.

Every single one of your behavioral answers needs a clear structure. The STAR method (Situation, Task, Action, Result) is your best friend here. It forces you to be concise and outcome-focused, which is exactly how bankers think.

Let’s apply this to a classic question: "Tell me about a time you failed."

Situation: Set the scene, quickly. "In my corporate finance class, I was leading a team of four on a major valuation project."

Task: What was your job? "My role was to combine everyone's models into our final deck. I totally underestimated how different everyone's formatting was and waited too long to start."

Action: What did you do about it? "The second I realized we were falling behind, I called an emergency team meeting, owned up to my mistake, and we pulled an all-nighter to rebuild a cohesive model from the ground up."

Result: What happened, and what did you learn? "We submitted the project on time and got a B+. The real lesson for me was about proactive project management and communicating early, which is something I’ve drilled into every team project since."

This framework turns a simple story into proof of ownership, problem-solving, and self-awareness.

Navigating the Modern Recruiting Landscape

It also pays to know what’s happening in the market right now. The recruiting world for banking is at a critical inflection point. After a slow period for deals, M&A is picking back up, and banks suddenly find themselves short-staffed. This makes them extremely picky.

They're prioritizing candidates who scream "stability" and have proven they can execute. They want to see minimal job-hopping and, for anyone moving laterally, a real track record of closed deals. This context just doubles down on the need for a flawless interview performance. Firms are taking fewer chances, so proving you're ready and committed for the long haul is more critical than ever.

Recommended Study Resources and Tools

Getting to this level of readiness requires a plan and the right tools. Trying to cram the week before your first superday is a guaranteed way to fail. Your preparation should start months ahead and blend theory with tons of hands-on practice.

Here are some of the go-to resources that have helped countless candidates break in:

Key Study Guides

Breaking Into Wall Street (BIWS) 400 Questions: This is basically the bible for technical prep. If you know this guide inside and out, you’re covered for 95% of the questions you'll get.

Wall Street Oasis (WSO) Technical Guide: Another fantastic resource that offers crisp, clear explanations of all the core concepts.

The "Red Book" (Investment Banking by Rosenbaum & Pearl): This is a proper textbook. It provides a much deeper, more academic dive into valuation and M&A, perfect for cementing your foundational knowledge.

Practice and Drills

Mock Interviews: This is the single most important part of your prep. You have to practice answering questions out loud, ideally with friends who are also going through recruiting. Aim for at least 10-15 mock interviews before your first real one.

AI-Powered Platforms: Tools like AskStanley are a total game-changer. They offer unlimited, surprisingly realistic mock interviews and smart drills that focus on your weak areas. It lets you get hundreds of reps in without bugging every person in your network.

By combining the knowledge from these guides with relentless practice through mock interviews, you build the confidence and competence to be at your best when it actually counts.

Winning the Superday and Securing Your Offer

This is it. The Superday is the final boss battle in your quest to break into investment banking. Think of it as a high-stakes marathon of back-to-back interviews, usually with five to eight different bankers. They’re not just testing if you’re smart; they’re testing your stamina, your consistency, and frankly, whether you’re someone they can tolerate at 2 AM in the office.

Your energy and sharpness in the first interview need to match your performance in the last. One bad conversation can sink your entire day, even if the others felt perfect. Consistency is everything.

Navigating Interviews with Different Seniority Levels

A rookie mistake is treating every interviewer the same. You have to read the room and adapt your approach based on who’s sitting across from you, because each seniority level is screening for something completely different.

Analysts and Associates: These are your future peers. They want to know if you can handle the grunt work without complaining. Your conversation should be grounded and technical. Show them you’ve got the modeling skills and attention to detail to be useful from day one.

Vice Presidents (VPs): VPs are the project managers. They’re looking for someone reliable who can execute tasks and think critically about the deal process. They care less about how you built the model and more about if you understand the why behind the numbers.

Managing Directors (MDs): MDs are the rainmakers, focused on the big picture and winning business. Forget the technical minutiae here. This conversation is about your market awareness, your long-term ambitions, and your personality. It’s the ultimate "airport test"—could they stand being stuck in an airport with you for five hours?

An MD has the final say. Your ability to connect with them on a personal level, beyond just the technicals, can be the single most important factor in getting the offer. They’re looking for someone who is not just capable, but also engaging and genuinely curious about the industry.

This is where your knowledge of recent deals really pays off. Bringing up a transaction the firm recently worked on is a fantastic way to engage a senior banker. If you need help breaking down deals and discussing them intelligently, check out our guide on mastering investment banking case studies.

Asking Questions That Make an Impact

When they ask, “So, what questions do you have for me?” don't throw away your shot with a generic question. This isn't a formality; it’s one last chance to impress.

Make your questions thoughtful and specific to the person you're talking to.

For an Analyst:

"What was the steepest part of your learning curve in the first year, and what did you do to get up to speed?"

"Could you walk me through what a first-year analyst actually did on a recent deal your team closed?"

For a Managing Director:

"I saw the firm advised on the [Specific M&A Deal]. From your perspective, what were the most interesting strategic drivers that made that transaction happen?"

"How are you seeing [a specific market trend] impact your clients in the [industry] sector over the next year or so?"

Questions like these prove you’ve done your homework and are thinking like a banker, not just a student.

The Post-Superday Follow-Up

You're not done when you walk out the door. A brief, personalized thank-you email to every single person you interviewed with is non-negotiable. Get it sent within 12 hours.

The key here is to make it memorable. Don’t just send a generic "Thank you for your time." Reference a specific part of your conversation. Something like, "I particularly enjoyed our discussion on the future of the semiconductor industry," shows you were actually listening and engaged.

Handling the Offer (and the Wait)

Now comes the hard part: waiting. Offers can roll in within a few hours or take up to a week. If you get an "exploding offer" (one with a tight deadline) from another bank, it's perfectly acceptable to professionally let your top-choice firm know. It might just speed up their decision.

When the call finally comes, stay cool. Express your excitement, but remain professional. Ask for the offer details in writing and request a reasonable amount of time (usually a few days to a week) to make your decision.

You've earned this moment. Enjoy it.

Frequently Asked Questions About Breaking Into Investment Banking

Trying to land an offer in investment banking is a grind, and it’s easy to get lost in the weeds. I get a ton of questions from aspiring bankers, so let's cut through the noise and tackle the ones that pop up most often.

The journey is tough, no doubt. But with the right strategy, a lot of the hurdles that seem impossible are actually manageable. Let's clear up some of the biggest questions you probably have.

Can You Realistically Break In From a Non-Target School?

Yes, you absolutely can. But you have to be relentless and way more strategic than your Ivy League counterparts. Students from "target" schools like Wharton or LSE have on-campus recruiting and massive alumni networks handed to them. You don't.

That means your game plan has to be different. You have to out-hustle everyone else.

Network Aggressively: You’re building your network from scratch. This means sending hundreds of personalized cold emails and LinkedIn messages. Your goal isn't just to chat; it's to turn those informational interviews into internal referrals that get your resume past the HR screen.

Flawless GPA and Resume: You have zero room for error here. Think 3.7+ GPA, minimum. Your resume needs to be perfectly formatted and loaded with quantifiable results from every experience you've had.

Be Technically Sharper: When you finally get that interview, you have to prove you’re more prepared and hungrier than the competition. You need to know your technicals cold.

Breaking in from a non-target is a pure numbers game. You might have to send 200 emails to get the same number of calls a target-school kid gets from sending 50. Don't get discouraged. Persistence is everything.

What Does the Typical Recruiting Timeline Look Like?

Forget what you think you know—investment banking recruiting has sped up like crazy. For a summer analyst internship, which is the main way in, the whole process kicks off more than a year before the internship even starts. If you don't know the timeline, you're already behind.

Here’s a rough sketch for an undergrad shooting for a junior year summer internship:

Academic Year | Key Recruiting Activities |

|---|---|

Freshman Year | Lock down a high GPA. That's your only job. Join a finance club and start learning the basics of accounting. |

Sophomore Fall | Land a decent sophomore summer internship—think corporate finance, wealth management, anything relevant. Start some light networking. |

Sophomore Spring | This is go-time. Ramp up networking hard. Polish your resume and start grinding technical prep. Applications for next year's internships start opening now. |

Sophomore Summer | Applications are live everywhere, and banks are already holding interviews and Superdays for the following summer. |

It starts early and moves incredibly fast. Staying organized and being proactive is the only way to survive.

How Much Technical Knowledge Is Enough for an Internship Interview?

This is what keeps most people up at night. The good news? You don't need to be a seasoned M&A pro. The bad news? You absolutely must have a rock-solid grip on the fundamentals.

Interviewers aren't trying to see if you can run a deal. They're testing your foundation and seeing how you think on your feet when the pressure is on.

For an internship interview, "enough" means you can confidently:

Walk through the three financial statements: You have to explain how the Income Statement, Balance Sheet, and Cash Flow Statement all link together. No excuses.

Explain core valuation methods: Be able to clearly articulate the concepts behind a DCF, Public Comps, and Precedent Transactions. What are they, and why would you use one over the other?

Answer basic accounting questions: You will get asked the classic "$10 depreciation" question. You also need to understand concepts like working capital inside and out.

No one expects you to build an LBO model from scratch in an interview. But they absolutely expect you to nail the foundational questions without stumbling. It shows you're serious and have a genuine desire to learn.

Reading guides is one thing, but acing these interviews comes down to practice—and a lot of it. AskStanley AI gives you unlimited, realistic mock interviews and smart drills to make sure you can deliver crisp, offer-winning answers every time. Stop guessing if you're ready and start mastering the skills that will actually land you the job.