Your Guide to the Investment Banking Mock Interview

An investment banking mock interview is the single most effective tool you have for Superday prep. Why? Because it’s the only thing that simulates the intense, real-world pressure you're about to face.

It’s one thing to read a guide; it’s another to deliver a crisp answer when an MD is staring you down. Mocks are designed to build that critical muscle memory for both the technical grilling and your behavioral stories, replicating the high-stakes environment where confidence—or lack of it—is immediately obvious. A single mock interview will expose weaknesses that hours of reading never could.

Why Mocks Are Your Highest ROI Prep Tool

Reciting answers you memorized from a guide is easy. Delivering them with conviction under fire is a completely different skill. Investment banking interviews are designed to test your composure just as much as your technical chops, and a mock interview is the only thing that bridges that gap. It moves you from just knowing the material to actually performing.

This isn't a passive exercise. You're forced to think on your feet, connect different financial concepts on the fly, and tell your story coherently—all while being judged. This is where you find out if your "walk me through your resume" pitch actually lands or if your valuation explanation crumbles after one simple follow-up question.

Building Performance Muscle Memory

Every mock you do builds a layer of what I like to call "performance muscle memory."

The first time you’re asked to walk through a DCF from scratch, you’ll probably stumble. The second time, it’s a little smoother. By the third or fourth time, the structure, key drivers, and potential pitfalls feel like second nature. This isn’t just about memorizing steps; it's about internalizing the logic so you can handle any curveball the interviewer throws your way.

The goal of an investment banking mock interview isn’t to get every question right. It's to experience the pressure, find your breaking points, and build the resilience to perform flawlessly when it actually counts.

This practice goes way beyond the technicals. You'll also fine-tune the tone and delivery of your behavioral answers so you sound authentic and motivated, not like you're reading from a script. It’s your chance to practice navigating from a story about a team project directly into a technical question about its financial impact—a classic interview tactic.

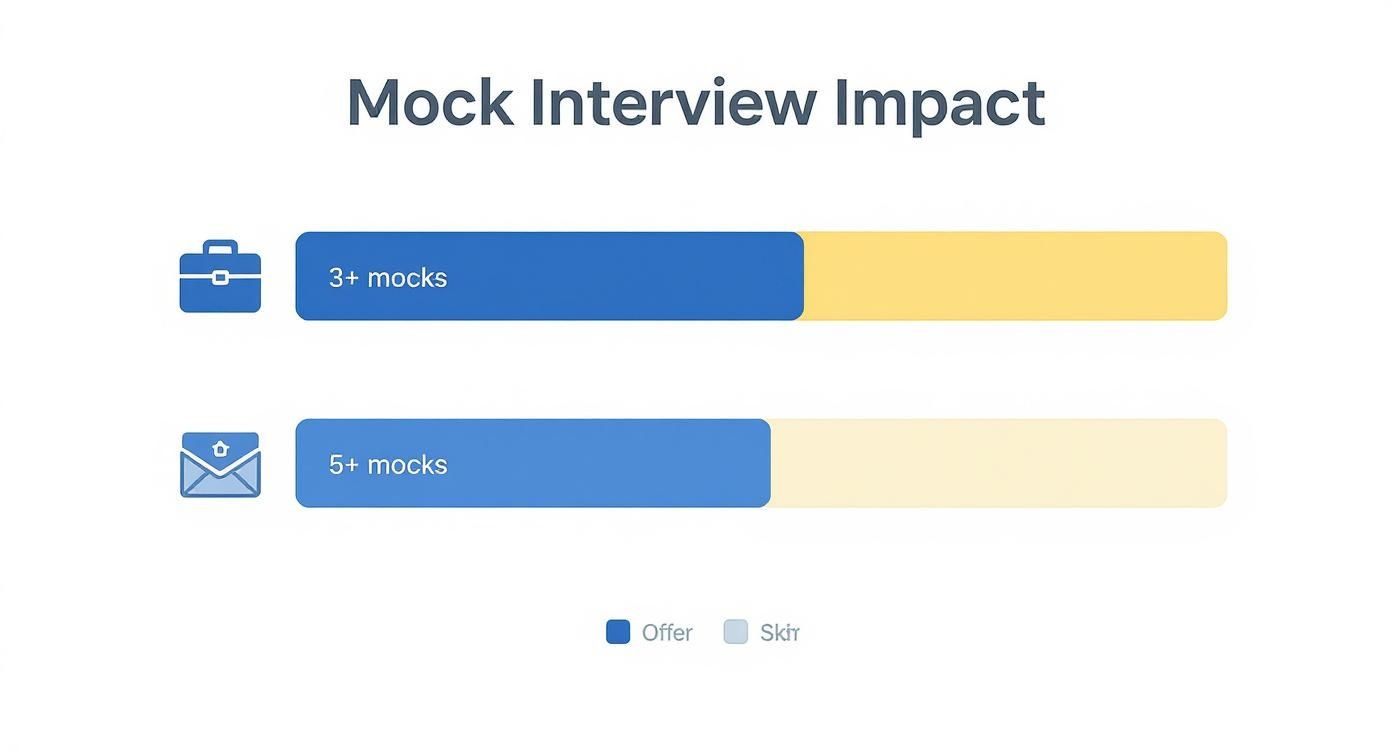

The Undeniable Data Behind Mock Interviews

The value of doing mocks isn't just a hunch; it's backed by hard data on who actually gets offers. The numbers show a direct, undeniable link between the number of structured mocks you do and your odds of landing a job.

For example, data from top university career centers shows that over 70% of students who landed summer analyst roles at bulge bracket and elite boutique firms did at least three mock interviews.

Even more telling, a comprehensive survey found that candidates who completed five or more mocks had a 42% higher chance of getting a full-time offer compared to those who did fewer than two. That's a massive difference. You can dig into more of these recruiting inflection points to see just how much preparation moves the needle.

To put it simply, look at how the offer rates climb with more practice.

How Mock Interviews Boost Offer Rates

This table breaks down the correlation we see between mock interview volume and candidate success. The more you practice in a realistic setting, the more polished and confident you become.

Number of Mocks Completed | Observed Impact on Performance | Key Takeaway for Candidates |

|---|---|---|

0-1 Mocks | High anxiety; answers are often robotic or incomplete. Struggles to handle follow-up questions. | You're flying blind. This is barely enough to spot your most glaring weaknesses. |

2-4 Mocks | Increased confidence; technical answers are more structured. Behavioral stories start to sound natural. | You're getting comfortable. You've ironed out the major kinks but still risk being surprised on game day. |

5+ Mocks | Polished delivery; handles pressure with ease. Can adapt answers on the fly and seamlessly transition between topics. | You're battle-tested. You've seen enough variations to handle almost anything an interviewer throws at you. |

The data makes it clear: more mocks lead to more offers. Each session sharpens your skills and builds the muscle memory needed to succeed.

The chart below visualizes this relationship perfectly.

As you can see, hitting that five-mock threshold is where things really start to take off. It’s where you move from just being "prepared" to being a truly polished candidate. Investing your time here is one of the smartest decisions you can make in your entire recruiting process.

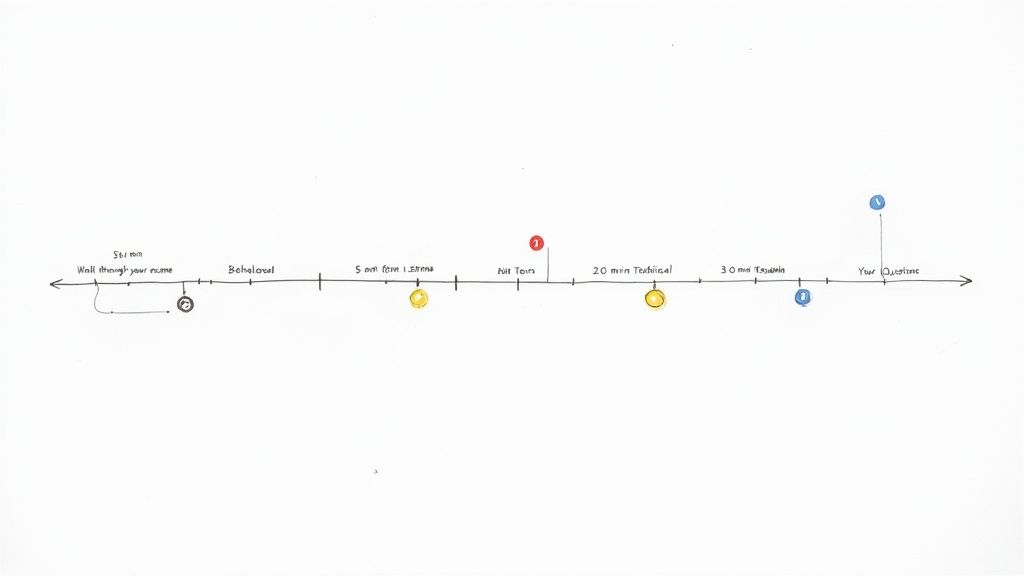

Decoding the Mock Interview Cadence

A solid investment banking mock interview isn't just a random volley of questions. It's a dress rehearsal, a structured simulation that’s designed to feel exactly like the real thing. Most of these interviews, mocks included, stick to a pretty predictable 45-minute rhythm.

Getting this cadence down is your first win. It prepares you for the mental gymnastics of switching from telling your story one minute to crunching numbers the next—all while under a microscope. The entire thing is a test: can you communicate complex ideas clearly, whether it’s your background or the guts of an LBO model? This structure is designed to see if you have that crucial mix of soft skills and technical chops.

The First Five Minutes: Nailing Your Pitch

Almost every interview kicks off with some version of "walk me through your resume" or "tell me about yourself." Don't mistake this for small talk. This is your opening pitch. You’ve got about 90 to 120 seconds to deliver a compelling story that connects the dots from your past experiences straight to a future in investment banking.

Your mission here is to be sharp, confident, and memorable. A killer pitch seamlessly flows into why you want this specific role at this specific firm, setting a positive vibe for the rest of the conversation. It’s your one chance to frame the narrative before the real grilling begins.

The Next 20 Minutes: The Behavioral Deep Dive

Once your intro is done, get ready for about 20 minutes of behavioral and "fit" questions. The interviewer is trying to poke holes in your story and figure out who you are as a person. They need to know if you're someone they can trust and, frankly, tolerate during those 100-hour workweeks.

You'll get hit with questions like:

Why investment banking? They’re testing if you actually know what you're signing up for.

Why our firm? This proves you’ve done your homework and aren't just blasting out applications.

Tell me about a time you worked on a team. They’re looking for proof of leadership, collaboration, and how you handle friction.

Describe a time you failed. This is all about self-awareness, resilience, and whether you learn from your screw-ups.

This is where you bring your resume to life. Structure your answers with specific examples to back up claims about your work ethic, attention to detail, and ability to stay cool under pressure.

Pro Tip: A classic interviewer move is to pivot hard from behavioral to technical. You might finish talking about a project from your last internship, and they'll immediately ask, "Interesting. What was that company's EBITDA, and how would you value it?" Be ready for those sharp turns.

The 20-Minute Technical Gauntlet

Next up is the technical gauntlet, another 20-minute block where your financial knowledge gets put on blast. The questions will hit the core pillars of banking analysis, and you need to be both accurate and conceptually solid. If you nail the easy questions, expect them to ramp up the difficulty fast.

An interviewer will usually jump between a few key areas:

Accounting: Questions on the three financial statements, how they link up, and core concepts like Working Capital or Deferred Revenue.

Valuation: You'll have to explain the main valuation methods (Comps, Precedents, DCF) and intelligently discuss their pros and cons.

M&A and LBO Concepts: Expect to get grilled on accretion/dilution, synergies, or the mechanics of a leveraged buyout.

A simple prompt like "Walk me through a DCF" can quickly spiral into a deep dive on WACC assumptions or terminal value calculations. The key isn't just reciting memorized answers—it's showing you genuinely understand how these concepts work.

The Final Five Minutes: Your Turn to Drive

The last five minutes are for you. This isn’t a courtesy; it's a critical, often-missed part of the interview. The questions you ask are a direct signal of your interest, curiosity, and how engaged you really are.

Don't ask something you could find with a two-second Google search. Instead, ask thoughtful questions about the interviewer’s own experience, the team culture, or a recent deal they worked on. This is your last chance to build rapport and leave a strong impression. A smart question here can be the tie-breaker between you and another candidate.

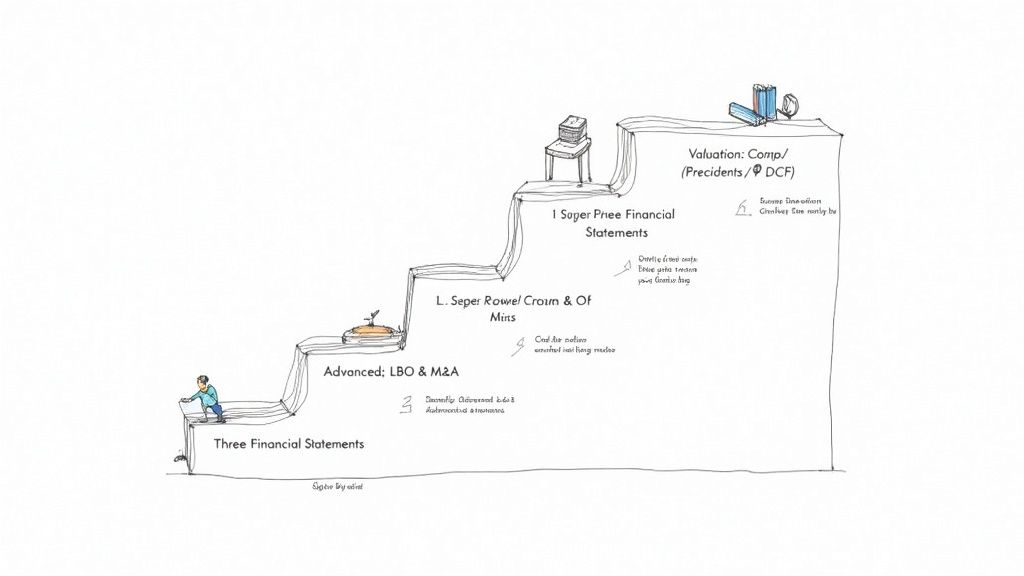

Building Your Technical Drill Plan

Look, mastering the technicals for an investment banking interview isn't about memorizing a thousand flashcards. Anyone can do that. It's about building a mental framework that lets you answer any question thrown your way, especially the weird follow-ups designed to see if you actually get it.

A solid drill plan is your roadmap. It takes you from the absolute basics to the more complex deal mechanics in a logical way. You're not just memorizing definitions; you're learning to explain the "why" behind the numbers. An interviewer doesn't care if you can list the three valuation methods. They want to see if you understand the nuances—like when to use each one and how to defend your assumptions when they push back.

Start with the Three Financial Statements

Everything in finance is built on accounting. If your understanding of how the Income Statement, Balance Sheet, and Cash Flow Statement talk to each other is shaky, your more advanced knowledge will crumble under pressure. Period.

This is where you have to start your drills. Don't just list what's on each statement. Practice explaining how a $10 increase in Depreciation flows through all three, hitting everything from Net Income to Cash from Operations and the PP&E balance. Nailing this flow-through question is a rite of passage.

Your drill list for this first tier should be airtight:

The Depreciation Flow-Through: How does a $10 increase in D&A hit the three statements? Be able to walk through it step-by-step without stumbling.

Linking the Statements: If you could only have two statements to build the third, which two would you pick? (The answer is the Income Statement and Balance Sheet). More importantly, can you explain why?

Working Capital Nuances: Explain what happens to cash flow when Accounts Receivable goes up. Why is an increase in a current asset a use of cash? This trips up a lot of people.

Master Core Valuation Methods

Once your accounting foundation is solid, it's time to move on to valuation. This is the heart and soul of most technical interviews. Structure your practice around the big three: Comparable Company Analysis (Comps), Precedent Transactions, and the Discounted Cash Flow (DCF) model.

For each method, you need to be ready for the deeper, conceptual questions that go beyond a simple definition. They want to test your real-world understanding. For a complete rundown of questions, our guide on investment banking technical questions is a great resource to build the depth they're looking for.

Focus your practice drills on questions like these:

Comps vs. Precedents: Why do Precedent Transactions almost always give you a higher valuation than Comps? (Hint: control premium).

DCF Drivers: What are the most important assumptions that drive a DCF model? How would you sensitivity test them?

Methodology Selection: Which valuation method would you use for a pre-revenue tech startup? Why?

Question: "Walk me through a DCF."

Structured Answer: "A DCF values a company based on the present value of its future cash flows. First, I'd project out its Unlevered Free Cash Flow for a 5-10 year period. That starts with EBIT, which I'd tax, and then adjust for non-cash items like D&A and changes in Working Capital and CapEx. Second, I'd calculate a Terminal Value using either the Gordon Growth Method or an Exit Multiple. Third, I'd discount those cash flows and the Terminal Value back to today using the Weighted Average Cost of Capital, or WACC. The sum gives me the company's Enterprise Value."

This clean, logical structure—what it is, the steps, and the conclusion—is exactly how a banker thinks and speaks.

Tackle Advanced LBO and M&A Concepts

With valuation down, the final part of your drill plan should cover deal mechanics. You don't need to be a modeling guru, but you absolutely have to understand the fundamentals of how Leveraged Buyouts (LBOs) and Mergers & Acquisitions (M&A) models work.

Think of an LBO as just another valuation, but from the perspective of a private equity fund. The key is understanding how leverage, debt paydown, and multiple expansion drive investor returns. For M&A, it's all about accretion and dilution—does the deal make the acquirer's Earnings Per Share (EPS) go up or down?

Key questions to nail for this tier:

Ideal LBO Candidate: What makes a company a good LBO target? (Think stable cash flows, strong management, low CapEx requirements).

Accretion/Dilution: Walk me through the quick math for an accretion/dilution analysis in an all-stock deal.

Synergies: What are synergies, and how are they modeled? What's the difference between revenue and cost synergies?

By tackling your technical prep in this order—accounting, then valuation, then deal mechanics—you're not just memorizing facts. You're building a pyramid of knowledge that will hold up during the toughest technical grilling.

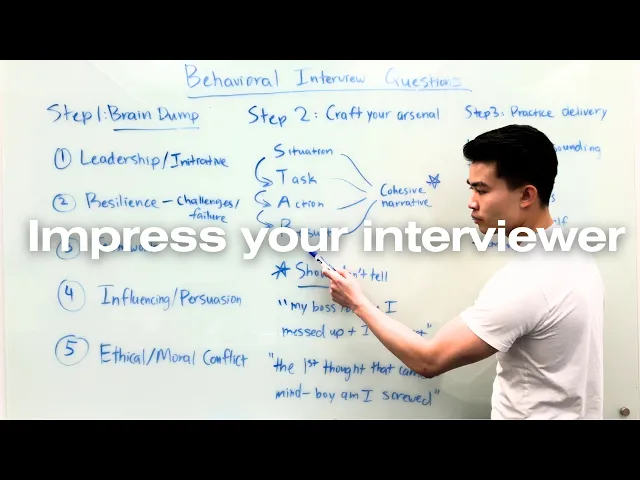

Crafting Your Authentic Behavioral Story

Technical skills might get you to the final round, but your story is what gets you the offer. The behavioral part of the interview is where so many sharp candidates fall apart. It's not because they lack good experience—it’s because they fail to wrap that experience into a compelling story.

Bankers aren't just ticking boxes. They want to know if you have the grit, teamwork skills, and insane attention to detail needed to survive (and thrive) as an analyst.

Simply reciting the STAR method isn’t going to cut it. The real work is building a "story bank" of your most powerful experiences and knowing exactly how to map them to the core traits bankers are looking for. This isn't about making things up; it's about framing what you've already done to show you have the DNA of a great banker.

Building Your Core Story Bank

Before you walk into any mock interview, you need five to seven core stories in your back pocket. These are your go-to narratives—the versatile experiences you can twist and turn to answer a whole range of questions. Don't just focus on your finance internships. Think about tough academic projects, leadership roles in clubs, or that demanding part-time job you had.

For each story, connect it to the key traits interviewers are screening for.

Resilience and Work Ethic: That time you were crushed by a deadline or had to juggle three competing priorities at once.

Teamwork and Leadership: An instance where you stepped up to resolve a group conflict or took the lead on a team project that was going nowhere.

Attention to Detail: A situation where your careful eye caught a mistake that everyone else on the team missed.

Quantitative Acumen: An example of when you used data to make a decision or solve a problem that seemed purely qualitative at first.

The goal here is to build a flexible arsenal. A single story about a brutal group project could be your answer for a question about leadership, failure, or teamwork, all depending on how you frame it.

Transforming the Mundane into the Memorable

You don't need to have worked on a billion-dollar M&A deal to have a killer story. Let’s take something everyone has done—a university group project on a company valuation—and see how to make it powerful.

Instead of saying, "We did a valuation of Nike for a class," you reframe it to showcase banking-specific skills.

Weak Answer: "In my corporate finance class, my team and I had to build a DCF for Nike. We projected their financials, calculated WACC, and presented our findings."

This is just a list of tasks. It’s boring, and it tells the interviewer nothing about you.

Strong Answer: "Our team was tasked with valuing Nike, but we immediately hit a roadblock when two members had conflicting views on the long-term growth rate. I took the initiative to build two separate DCF scenarios to model both outcomes, which helped us have a data-driven discussion. My analysis ultimately showed one assumption was more defensible, and I was able to get the team to consensus, which led to us earning the highest grade in the class."

See the difference? This version shows leadership, analytical thinking, and a focus on results. You took a standard project and spun it into a story of problem-solving and collaboration. That’s what interviewers actually remember.

Answering the "Why Investment Banking?" Question

This is the ultimate gatekeeper question. Your answer has to be a perfect blend of your personal drive, your skills, and your understanding of what the job actually entails. It needs to logically connect your past experiences to your future goals. For a deeper look at this, check out our complete guide on investment banking behavioral questions.

A great answer always has three parts:

The "Spark": A specific, early experience that first got you interested in finance or M&A.

The "Exploration": How you actively chased that interest through classes, internships, or networking.

The "Connection": Why all of this leads you to this specific bank and this role, proving you know what you’re signing up for.

You can't fake genuine enthusiasm. Your tone and conviction matter just as much as your words. When you're doing your investment banking mock interview, practice delivering this story with energy. Make it stick.

How to Run a Realistic Mock Interview

Knowing the theory is one thing, but actually executing under pressure is what gets you the offer. A realistic mock interview isn’t just about having someone ask you questions; it’s about simulating the exact, high-stakes environment you'll face on a Superday.

The whole point is to make the real thing feel like just another practice round. You get there by following a "progressive overload" model—start with safer partners to work out the kinks, then slowly ramp up the pressure as your real interviews get closer. This approach builds confidence and systematically plugs the holes in your game.

Sourcing Your Interview Partners

You'll want a mix of people grilling you to get different perspectives and prepare for various interview styles. Don't just rely on one source.

Dedicated Peers: Start here. Find one or two classmates who are just as serious about recruiting as you are. They’re perfect for those initial run-throughs to smooth out the rough edges of your stories and technical answers.

Alumni and Mentors: Once you feel more polished, it’s time to reach out to alumni or junior bankers you’ve been networking with. Their feedback is gold because they’ve been through it recently and know exactly what their firms are looking for.

Paid Coaches and Services: Think of this as a strategic investment, especially for your final-round prep. Professional coaches, usually ex-bankers, are masters at replicating the intimidating vibe of a top-tier bank and will give you the brutally honest feedback your friends might not.

This kind of focused prep is becoming a huge deal. The global finance coaching industry, valued at around $1.2 billion in 2023, is expected to climb to $1.8 billion by 2026. And it works. Data from one major prep platform showed that candidates using their mock interview services had a 38% higher conversion rate from first-round interviews to offers. You can dig into more of these investment banking acceptance rate trends to see for yourself.

Creating a High-Pressure Simulation

To get your money's worth out of a mock interview, you have to treat it like it's real. That means creating an environment of maximum pressure and professionalism. Forget the casual chat over coffee; this is a full dress rehearsal.

Set up every session with these non-negotiable rules:

Dress the Part: Full business professional attire. No exceptions. It’s amazing how putting on the suit flips a mental switch and puts you in performance mode.

Use Video: Always do your mocks over a video call. This mirrors the virtual interviews you’ll likely have and gets you comfortable making eye contact through a camera.

Eliminate Distractions: Phone off. All other tabs closed. Make sure no one will interrupt you. You need total focus.

Stick to the Clock: Use a timer. A standard interview slot is 45 minutes. This forces you to be concise and manage your time, especially when it’s your turn to ask questions at the end.

The point of a mock isn't to be comfortable; it's to practice being uncomfortable. The more pressure you can simulate now, the calmer and more collected you'll be when it's game time.

After every mock, set aside at least 15-20 minutes for a structured feedback session. Score everything from technical accuracy to the delivery of your behavioral answers. For a solid framework on what to track, check out our guide on key interview skills to practice.

And a pro tip: record your sessions if you can. Watching yourself back is a powerful (and sometimes cringeworthy) way to spot bad habits you didn't know you had.

Common Interview Mistakes and How to Fix Them

Even the sharpest, most technically gifted candidates get dinged for simple, unforced errors. This is where a mock interview becomes your secret weapon—it's the perfect place to spot and fix these subtle mistakes before they cost you an offer.

We're not talking about obvious stuff like showing up late. We're talking about the nuanced missteps that separate a good candidate from a great one in the eyes of an interviewer who has seen it all.

Knowing what these pitfalls look like is half the battle. Let's break down the most common ones I've seen trip people up.

Rambling and Unfocused Answers

This is probably the most frequent mistake. When you get nervous, it’s easy to start talking in circles, hoping that somewhere in that five-minute monologue is the answer the interviewer is looking for. It just signals a lack of structure and an inability to be concise.

The fix? I call it the "one-minute rule." Practice structuring your behavioral answers so you can deliver the core message in roughly 60-90 seconds. This forces you to be direct and punchy, leaving room for the interviewer to dig deeper if they want more detail.

Coming Across as Arrogant

There’s a razor-thin line between confidence and arrogance, and way too many candidates cross it without ever knowing. Confidence is owning your achievements. Arrogance is acting like you know it all or downplaying what others brought to the table.

The easiest fix is to shift your language from "I" to "we" when you're talking about team projects. Give credit where it's due and focus on what the team accomplished together. This shows you're a team player—which is absolutely non-negotiable in banking.

Asking Generic or Obvious Questions

When the interviewer asks, "Do you have any questions for me?" this is your final chance to make an impression. Asking something like, "What's the culture like?" is a massive missed opportunity. It shows you haven't done your homework and are just going through the motions.

Instead, come prepared with sharp, specific questions that prove you've done your research.

Bad Question: "What kind of deals does your bank do?"

Good Question: "I saw your team advised on the XYZ acquisition last quarter. I was curious how the current high-yield debt market affected your financing strategy for that deal?"

A thoughtful question like that shows you're already thinking like an analyst, not just another applicant. It leaves a lasting positive impression.

Even after you’ve built a solid prep plan, you’re going to have questions. Everyone does. Let's tackle the most common ones that come up during the mock interview grind.

How Many Mock Interviews Should I Actually Do?

There isn't a magic number, but the sweet spot is usually between three to five high-quality sessions. The key word here is quality, not quantity.

Your first one or two can be with trusted friends who are also deep in the recruiting process. This is your chance to iron out the obvious kinks in your stories and make sure your technical explanations make sense out loud.

After that, you need to level up. The next few should be with alumni, mentors, or even a professional coach. You're looking for someone who won't hold back and can give you blunt, expert feedback. You’ll know you're ready when their critiques get smaller and you feel confident handling curveball questions, not just when you hit some arbitrary target.

Is Paying for a Mock Interview Worth It?

Honestly, it can be a game-changing investment, especially if you don't have a deep network of bankers to tap into. A paid coach, often a former banker themselves, offers an unbiased, professional perspective that you just can't get from campus career services. They know exactly how to replicate the high-pressure environment of a top-tier bank.

If you find yourself consistently getting to final rounds but never landing the offer, a professional coach can be the one to spot that tiny, subtle mistake that's holding you back. That targeted feedback can be the difference-maker.

Where Can I Find Good Mock Interview Partners?

Start with the people right next to you. Pull together a small, serious study group with peers who are just as committed as you are. This is the best place for your first few reps in a lower-stakes setting.

Next, hit your school's alumni database and LinkedIn. A polite, well-crafted message to a junior banker asking for a 30-minute mock session often works—they were in your shoes not too long ago and are usually happy to help.

Finally, when you're ready for that final layer of polish, consider professional coaching services or dedicated prep platforms. They exist for a reason: to get you over the finish line.

Stop wondering if you're truly prepared. With AskStanley AI, you get infinite technical questions and realistic mock interviews that adapt to your skill level. Track your progress, identify your weak spots, and walk into your Superday with the confidence that comes from genuine readiness. Start your journey at https://www.askstanley.ai today.