Top 10 Investment Banking Technical Questions for 2025

Landing an offer in investment banking hinges on your ability to navigate a gauntlet of technical questions with precision and confidence. While memorizing hundreds of answers might seem like the goal, the real test is demonstrating a deep, interconnected understanding of corporate finance. True mastery isn't about reciting definitions; it's about explaining how concepts like valuation, accounting, and M&A mechanics interrelate in real-world scenarios. This is what separates a good candidate from a great one.

This guide breaks down the most critical categories of investment banking technical questions you will face. We go beyond simple Q&A formats to provide structured, model answers that reveal the logic behind the numbers. For each topic, you'll find:

Concise model answers to common questions.

Likely follow-up questions that interviewers use to test your depth of knowledge.

Difficulty tags to help you prioritize your study plan.

Actionable study tips and practice drills to solidify your understanding.

From the foundational 'walk me through the three financial statements' to the complexities of an LBO model and accretion/dilution analysis, this listicle is designed to be your definitive roadmap. We've structured this roundup to help you focus your preparation on the concepts that truly define your candidacy, building the core knowledge needed for both your interviews and a successful career on the Street. Let's dive into the technicals you need to master.

1. Three Financial Statements (Income Statement, Balance Sheet, Cash Flow Statement)

This is arguably the most fundamental of all investment banking technical questions. Interviewers use it to gauge your core understanding of accounting and how a company’s operations are financially represented. You must be able to articulate not just what each statement shows, but how they dynamically interact with one another.

A solid answer demonstrates that you can think through the ripple effects of a single business event, which is a critical skill for building financial models and performing valuation analysis. The question isn't just a memory test; it's a test of your logical and structured thinking.

Core Concept: The Linkages

The three statements are intricately connected. Net Income from the Income Statement is the top line of the Cash Flow Statement (in the Cash from Operations section). It also links to the Balance Sheet through Retained Earnings in Shareholders' Equity.

Changes to Balance Sheet items, like Accounts Receivable or Inventory, affect the Cash Flow Statement. Finally, the ending cash balance from the Cash Flow Statement becomes the cash asset on the next period's Balance Sheet, ensuring everything balances.

Sample Question & Answer Walkthrough

Question: "Walk me through how a $10 increase in depreciation expense flows through the three financial statements."

Answer:

Income Statement: Operating Income (EBIT) declines by $10. Assuming a 20% tax rate, Net Income decreases by $8 ($10 x (1-0.20)).

Cash Flow Statement: You start with the lower Net Income (down $8). However, since depreciation is a non-cash expense, you must add back the full $10. The net effect is a $2 increase in cash from operations.

Balance Sheet: On the assets side, Cash is up by $2, but Property, Plant & Equipment (PP&E) is down by $10 due to depreciation. Total assets are down by $8. On the liabilities and equity side, Retained Earnings is down by $8 (due to the drop in Net Income), balancing the equation.

Pro Tip: Always state your tax rate assumption clearly. It shows attention to detail and a deeper understanding of the mechanics. For a more detailed breakdown, you can learn more about how to walk through the 3 financial statements.

2. DCF Valuation Model with Sensitivity and Scenario Analysis

The Discounted Cash Flow (DCF) model is the cornerstone of intrinsic valuation and a frequent topic in investment banking technical questions. An interviewer will ask you to build a DCF to test your ability to make reasoned assumptions, project a company's financial future, and translate those projections into a present-day value.

This question goes beyond simple mechanics; it assesses your commercial acumen. Your ability to justify your assumptions for revenue growth, margins, and the discount rate is just as important as your ability to perform the calculations correctly. It shows you can think like an investor and understand the key drivers of a business's value.

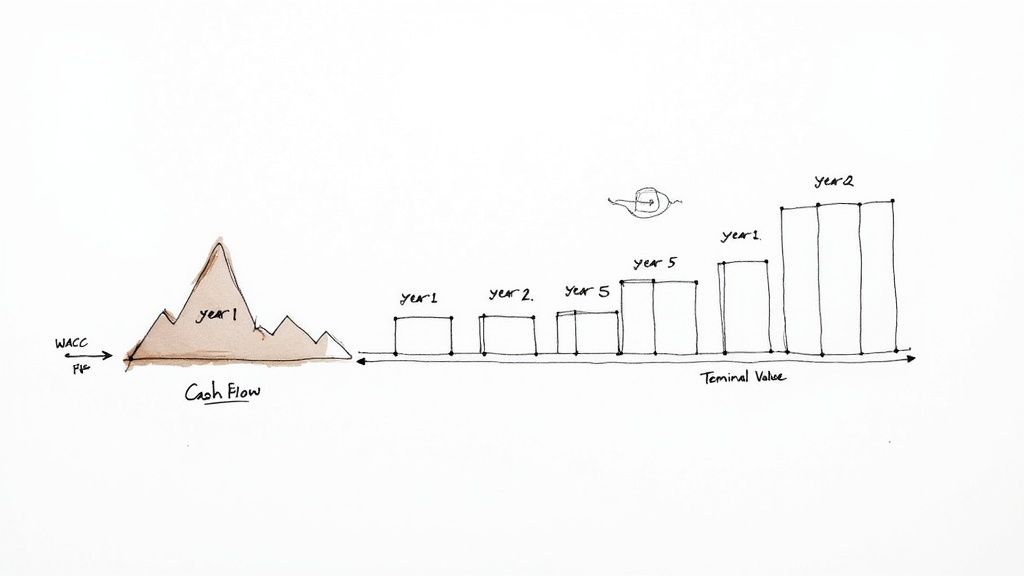

Core Concept: The Time Value of Money

A DCF analysis is built on the principle that a dollar today is worth more than a dollar tomorrow. The model projects a company's unlevered free cash flows over a forecast period (typically 5-10 years) and a "terminal value" for all cash flows beyond that. These future cash flows are then discounted back to their present value using the Weighted Average Cost of Capital (WACC).

The sum of these discounted cash flows equals the company's Enterprise Value. To get to Equity Value, you subtract net debt and other non-equity claims. The ultimate output, a per-share value, is compared to the current stock price to determine if a company is over or undervalued.

Sample Question & Answer Walkthrough

Question: "Walk me through a DCF model."

Answer:

Project Free Cash Flow: First, I would project the company's unlevered free cash flow for a 5 to 10-year period. This involves starting with EBIT, applying the effective tax rate, adding back non-cash charges like D&A, and subtracting changes in net working capital and capital expenditures. These projections are based on assumptions about revenue growth, margins, and capital intensity.

Calculate Terminal Value: Next, I would calculate the Terminal Value, which represents the value of the company's cash flows beyond the explicit forecast period. This is typically done using either the Gordon Growth Method, which assumes a perpetual growth rate, or the Exit Multiple Method, which applies a valuation multiple (like EV/EBITDA) to the final year's financials.

Discount to Present Value: I would then discount both the projected free cash flows and the Terminal Value back to the present day using the Weighted Average Cost of Capital (WACC) as the discount rate. The sum of these present values gives me the company's Enterprise Value.

Calculate Implied Share Price: Finally, to arrive at an implied share price, I would subtract Net Debt from the Enterprise Value to get the Equity Value and then divide by the company’s diluted shares outstanding.

Pro Tip: Always perform a sensitivity analysis on your key assumptions, such as WACC and the terminal growth rate. Presenting your valuation as a range (e.g., using a valuation football field) rather than a single number demonstrates a more sophisticated and realistic understanding of the analysis. For a deeper dive, our comprehensive guide can help you master the DCF Valuation Model with Sensitivity and Scenario Analysis.

3. Comparable Company Analysis (Comps Analysis)

Comparable Company Analysis, often called "Comps," is a relative valuation method used to determine a company's value by comparing it to similar publicly traded companies. Interviewers ask about Comps to test your understanding of market-based valuation, your ability to select a relevant peer group, and your grasp of key trading multiples like EV/EBITDA and P/E.

This method is fundamental to nearly every valuation project in investment banking. A strong answer shows you can think critically about what makes companies truly comparable and how to derive a reasonable valuation range from market data, a core skill for any analyst.

Core Concept: The Logic of Relative Value

The principle behind Comps is that similar companies should trade at similar multiples of their key financial metrics. The process involves identifying a set of comparable public companies, gathering their financial data, calculating their valuation multiples (e.g., Enterprise Value / EBITDA, Price / Earnings), and then applying the median or mean of those multiples to the target company's relevant financial metric to imply its valuation.

This method provides a "current" market perspective on value, reflecting prevailing investor sentiment and market conditions. It’s a reality check against intrinsic valuation methods like the DCF.

Sample Question & Answer Walkthrough

Question: "You're asked to value a mid-sized, private software-as-a-service (SaaS) company. Walk me through how you would perform a Comparable Company Analysis."

Answer:

Select the Universe of Comparables: I would start by screening for publicly traded SaaS companies. I'd narrow the list based on key criteria like business model (e.g., subscription-based), end markets (e.g., B2B vs. B2C), size (similar revenue or market cap), and growth profile (similar revenue growth and margin profile). The goal is to find 6-10 truly comparable peers.

Gather Financial Information: For each peer, I would gather market data like market capitalization and net debt to calculate Enterprise Value. I'd also pull LTM (Last Twelve Months) and forward one- and two-year projections for key metrics like Revenue, EBITDA, and Net Income from equity research reports or SEC filings.

Calculate Multiples: With this data, I'd calculate the relevant valuation multiples for each peer, such as EV/Revenue, EV/EBITDA, and P/E. For a high-growth SaaS company, EV/Revenue is often a primary multiple.

Benchmark and Apply to Target: I would then calculate the median and mean of these multiples for the peer group. Finally, I'd apply these median multiples to my target company's LTM Revenue and EBITDA to derive its implied Enterprise Value. This process gives me a valuation range, not a single number.

Pro Tip: Always be prepared to justify your choice of peer group. Acknowledging the limitations of your selected companies (e.g., "Company X is larger but has a similar business mix") shows sophisticated thinking and is a hallmark of strong investment banking technical questions.

4. Precedent Transactions Analysis (Accretion/Dilution Analysis)

This category of investment banking technical questions tests your understanding of M&A valuation and the financial impact of a transaction on the acquirer. Precedent Transactions Analysis (or "Comps") is a valuation method based on what similar companies have been sold for, while accretion/dilution analysis determines if a deal will increase or decrease the buyer's Earnings Per Share (EPS).

Interviewers ask this to see if you can think like an M&A advisor. A correct answer shows you can not only value a company based on market data but also analyze the critical pro-forma implications of a deal, which is a core responsibility for junior bankers. It’s a practical test of your ability to connect valuation theory to real-world deal consequences.

Core Concept: The Linkages

Precedent Transactions analysis involves finding historical M&A deals with similar target companies (in terms of industry, size, and geography) and calculating the valuation multiples (e.g., EV/EBITDA, P/E) paid in those deals. These multiples are then applied to the current target's financial metrics to derive a valuation range.

Accretion/Dilution analysis builds on this by modeling the combined company's financials. It takes the acquirer's standalone EPS and compares it to the pro-forma EPS, which is calculated by adding the target's net income, subtracting any new interest expense from deal debt, and adjusting for the new share count if stock was used to fund the purchase.

Sample Question & Answer Walkthrough

Question: "Walk me through a basic accretion/dilution analysis for an all-stock M&A deal."

Answer:

Project Financials: First, project the standalone Net Income for both the acquirer and the target company.

Calculate Offer Price & Shares: Determine the offer price per share for the target and calculate the total acquisition cost. Based on the acquirer's current stock price, you calculate how many new shares must be issued to the target's shareholders to pay for the deal.

Combine Net Income & Shares: Combine the Net Income of both companies. You would also add any expected synergies and subtract transaction costs. Then, add the newly issued shares to the acquirer’s existing shares outstanding to get the new pro-forma share count.

Calculate Pro-Forma EPS: Divide the combined pro-forma Net Income by the new pro-forma share count. If this new EPS is higher than the acquirer's original standalone EPS, the deal is accretive. If it's lower, the deal is dilutive.

Pro Tip: Always mention the key drivers of accretion and dilution. A deal is more likely to be accretive if the acquirer has a higher P/E ratio than the target, or if significant, achievable synergies are identified. Explaining this "why" demonstrates a superior level of understanding.

5. LBO (Leveraged Buyout) Model and Analysis

Questions about Leveraged Buyouts (LBOs) are a staple in both investment banking and private equity interviews. An LBO is the acquisition of a company using a significant amount of borrowed money (leverage) to meet the cost of acquisition. The purpose is to allow a financial sponsor, like a private equity firm, to make a large acquisition without having to commit a lot of their own capital.

This question type tests your ability to think like an investor. Answering correctly shows you understand how debt and equity work together to generate returns, how a business's cash flows can be used to service debt, and what key assumptions drive an investment's success. It’s a more advanced version of the three-statement question, requiring you to build a dynamic model over a multi-year forecast period.

Core Concept: The Return Drivers

The goal of an LBO is to generate an attractive internal rate of return (IRR) for the equity investors. This return is driven by three main levers:

Deleveraging: The company's free cash flow is used to pay down the acquisition debt over the holding period, increasing the equity value.

EBITDA Growth: Operational improvements, cost-cutting, or revenue growth increase the company’s EBITDA, which makes the company more valuable at exit.

Multiple Expansion: The sponsor sells the company for a higher multiple of its EBITDA than it was purchased for (e.g., buying at 8.0x and selling at 10.0x).

Sample Question & Answer Walkthrough

Question: "Walk me through a basic LBO model."

Answer:

Assumptions: "First, you make assumptions about the purchase price, debt/equity split, interest rate on debt, and the company's operating performance, like revenue growth and margins."

Sources & Uses: "Next, you create a Sources and Uses table. The Uses side shows the total cost of the acquisition (equity purchase price, fees), and the Sources side shows how you will pay for it (new debt, existing cash, sponsor equity)."

Pro-Forma Financials: "Then, you project the company's three financial statements for a 5-7 year period. You must build a debt schedule to track how free cash flow is used to pay down debt principal and interest each year."

Exit Calculation: "Finally, you assume an exit multiple (often the same as the entry multiple) to calculate the company's enterprise value at the end of the holding period. After subtracting net debt, you arrive at the exit equity value."

Returns Analysis: "From the sponsor's initial equity investment and the final exit equity value, you can calculate the IRR and Multiple on Invested Capital (MoIC) to determine if it's a good investment."

Pro Tip: When discussing an LBO, always focus on the cash flow. An ideal LBO candidate is a mature company with stable, predictable cash flows, low capital expenditure requirements, and a strong management team. These characteristics ensure the company can service its heavy debt load.

6. M&A Deal Structure, Financing, and Accounting Treatment

Understanding the mechanics of an M&A transaction beyond just valuation is crucial. This area of investment banking technical questions tests your practical knowledge of how deals are structured, financed, and reflected on the financial statements. Interviewers want to see if you can think like an advisor, considering the strategic, financial, and tax implications for both buyer and seller.

A strong answer here shows you understand the real-world consequences of deal-making. It proves you can connect high-level strategy (e.g., all-stock vs. all-cash) to its detailed accounting impact (e.g., EPS accretion/dilution, goodwill creation).

Core Concept: The Transaction's Anatomy

Every deal has a distinct structure. A key distinction is between an asset purchase, where the buyer acquires specific assets and liabilities, and a stock purchase, where the buyer acquires the entire company (including all its assets and liabilities, known and unknown). The choice of financing (cash, debt, stock, or a mix) and the subsequent accounting treatment (e.g., purchase price allocation) fundamentally alter the buyer's balance sheet and future earnings.

Sample Question & Answer Walkthrough

Question: "A buyer acquires a target company. Why would the buyer strongly prefer to structure it as an asset purchase, while the seller would prefer a stock purchase?"

Answer:

Buyer's Perspective (Asset Purchase): The buyer's primary motivation is tax-related. In an asset purchase, the buyer can "step-up" the tax basis of the acquired assets to their fair market value. This creates higher depreciation and amortization expenses going forward, which shields future income from taxes, resulting in significant tax savings. The buyer also gets to pick and choose which liabilities to assume, avoiding hidden or contingent liabilities.

Seller's Perspective (Stock Purchase): The seller typically faces double taxation in an asset sale. First, the corporation pays tax on the gain from selling its assets. Then, the shareholders pay tax again when the proceeds are distributed as a dividend. In a stock sale, the shareholders are taxed only once at the personal level, usually at a lower capital gains rate. It provides a cleaner exit by transferring all liabilities to the buyer.

Pro Tip: Always frame your answer by considering the motivations of both parties. Mentioning the tax shield for the buyer and the double-taxation avoidance for the seller shows a complete and balanced understanding. For more context, you can explore the types of technicals you will get asked in your interviews.

7. WACC Calculation and Cost of Capital Components

Understanding the Weighted Average Cost of Capital (WACC) is fundamental for valuation, as it represents the minimum return a company must earn on its existing asset base to satisfy its creditors, owners, and other providers of capital. This is a staple of investment banking technical questions because WACC is the standard discount rate used in a Discounted Cash Flow (DCF) analysis.

Answering this question well shows you can grasp both the theoretical underpinnings and the practical application of corporate finance principles. It demonstrates your ability to synthesize various inputs like market data, company specifics, and tax effects into a single, critical valuation metric.

Core Concept: The Blend of Capital

WACC is the blended average rate a company is expected to pay to finance its assets. It is "weighted" because it reflects the proportion of equity and debt in the company's capital structure. The formula is: WACC = (E/V * Re) + (D/V * Rd * (1 - Tc)), where E is market value of equity, D is market value of debt, V is E+D, Re is the cost of equity, Rd is the cost of debt, and Tc is the corporate tax rate.

The cost of equity is often calculated using the Capital Asset Pricing Model (CAPM), while the cost of debt is based on the company's current borrowing rates. The (1 - Tc) component reflects the tax deductibility of interest payments, known as the tax shield.

Sample Question & Answer Walkthrough

Question: "Walk me through how you would calculate WACC for a company."

Answer:

Calculate the Cost of Equity (Re): First, I'd use the Capital Asset Pricing Model (CAPM). The formula is: Risk-Free Rate + Beta * (Equity Risk Premium). I would use the 10-year U.S. Treasury yield as the risk-free rate, find a comparable Beta for the company, and use a standard Equity Risk Premium, typically between 5% and 7%.

Calculate the Cost of Debt (Rd): I would look at the company’s existing debt and find the weighted average interest rate or yield to maturity on its outstanding bonds. For the tax shield, I'd use the company’s effective or marginal tax rate. The after-tax cost of debt is Rd * (1 - Tax Rate).

Determine the Capital Structure Weights: I would calculate the market value of equity (market capitalization) and the market value of debt. Then, I would determine the proportion of equity and debt in the capital structure (e.g., 60% equity, 40% debt).

Combine the Components: Finally, I would plug these values into the WACC formula: (Equity % * Cost of Equity) + (Debt % * After-Tax Cost of Debt). This gives me the company's WACC.

Pro Tip: Always specify your assumptions for each input, especially the risk-free rate and the equity risk premium. Mentioning that you would use the market value of debt and equity, not the book value, demonstrates a more sophisticated understanding.

8. Credit Analysis and Credit Metrics Interpretation

This category of investment banking technical questions tests your understanding of a company's ability to meet its debt obligations. It's crucial for roles in Debt Capital Markets (DCM), Leveraged Finance, and even M&A, as debt is a primary funding source. Answering these questions well shows you can think like a lender or bond investor, focusing on downside risk and cash flow stability.

Interviewers want to see if you can move beyond simple valuation and understand a company's financial health from a creditor's perspective. You must interpret key leverage and coverage ratios, analyze debt structure, and assess refinancing risk, which are core skills for any capital structure analysis.

Core Concept: Leverage and Coverage

Credit analysis boils down to two fundamental questions: can the company handle its current debt load (leverage), and can it generate enough cash to pay its interest and principal (coverage)? Leverage ratios like Debt/EBITDA measure the size of debt relative to earnings, while coverage ratios like EBITDA/Interest Expense measure the ability to service that debt.

A company with low leverage and high coverage is considered a strong credit, while one with high leverage and low coverage is seen as risky. The context is key; what is considered high leverage in a stable utility company might be normal for a high-growth tech firm.

Sample Question & Answer Walkthrough

Question: "A company's Net Debt/EBITDA has increased from 2.5x to 4.5x over the past two years. What are the potential reasons for this, and what are your main concerns as a credit analyst?"

Answer:

Identify the Drivers: This deterioration could be driven by two main factors. First, Net Debt could have increased, perhaps because the company took on new loans to fund an acquisition, a large capital expenditure project, or to cover operating losses. Second, EBITDA could have declined due to weakening business performance, such as lower sales, margin compression from rising costs, or losing market share. It could also be a combination of both.

Analyze the Implications (Concerns): My primary concern is the company's reduced ability to service its debt and its increased financial risk. The higher leverage means there is less cushion to absorb any further decline in business performance.

Outline Next Steps: I would investigate the root cause. I'd analyze recent financial statements to see if the driver was new debt issuance or falling profitability. I'd also look at the company's debt maturity schedule to assess refinancing risk, as lenders will be much more hesitant to provide new capital to a company with a weakening credit profile. Finally, I would check its debt covenants to see if it is at risk of a breach.

Pro Tip: Always contextualize your answer. Mentioning industry norms is critical. For example, a 4.5x leverage ratio might be acceptable for a stable, contracted business but would be a major red flag for a cyclical company heading into a recession.

9. IPO Process, Valuation, and Going Public Mechanics

Questions about the Initial Public Offering (IPO) process test your understanding of a critical function within investment banking: Equity Capital Markets (ECM). Interviewers want to see that you grasp the entire lifecycle of taking a private company public, from initial valuation discussions to the first day of trading. It’s a multi-faceted process combining valuation, marketing, legal, and strategic thinking.

A strong answer shows you can connect high-level strategy (why go public?) with granular mechanics (how is the offering priced?). This knowledge is crucial for ECM roles and demonstrates a well-rounded understanding of corporate finance for M&A or other groups.

Core Concept: The Path to Public Markets

An IPO is how a private company issues new shares to the public for the first time. The process is led by an underwriting syndicate of investment banks that helps the company navigate regulatory filings (like the S-1), market the shares to institutional investors through a roadshow, and ultimately determine an offer price.

The valuation is a key part of this, involving a blend of DCF analysis, comparable company analysis (using public comps), and assessing investor demand. The goal is to set a price that maximizes proceeds for the company while also ensuring a successful market debut.

Sample Question & Answer Walkthrough

Question: "A company is looking to go public. What are the key steps in the IPO process and how do you determine its valuation?"

Answer:

Engagement & Kick-off: The company selects an underwriting syndicate of investment banks. This begins a 6-12 month process involving lawyers, auditors, and the management team.

Due Diligence & Filing: The banks conduct deep due diligence on the company’s financials, operations, and market position. They then help draft the S-1 registration statement, which is filed with the SEC.

Valuation & Marketing: The syndicate establishes an initial valuation range using methods like DCF and trading comparables. The company then embarks on a "roadshow" to market the offering to institutional investors, gauging their interest (building the "book").

Pricing & Allocation: Based on investor demand from the roadshow, the underwriters and the company set the final offer price the night before the IPO. Shares are allocated to investors.

Trading & Stabilization: The stock begins trading on an exchange. The lead underwriter may engage in stabilization activities to support the stock price in the initial days. After a "lock-up period" (typically 180 days), insiders and early investors are allowed to sell their shares.

Pro Tip: When discussing valuation, mention the "IPO discount." Underwriters often price an offering slightly below its estimated intrinsic value to encourage a first-day "pop," which generates positive momentum and rewards early investors. This is a key nuance in understanding IPO pricing dynamics.

10. Financial Ratios, Profitability Analysis, and KPI Interpretation

Beyond understanding the three statements, interviewers need to see that you can use them to derive meaningful insights. This category of investment banking technical questions tests your ability to calculate key performance indicators (KPIs) and ratios, and more importantly, interpret what they reveal about a company’s operational health, profitability, and efficiency.

A strong answer here moves beyond simple definitions. You need to articulate the "so what" behind the numbers, comparing a company's performance against its peers and its own historical trends. This skill is central to equity research, credit analysis, and nearly every aspect of financial modeling and deal evaluation.

Core Concept: Context is Everything

Financial ratios are meaningless in a vacuum. A 10% net profit margin might be outstanding for a low-margin retailer but disastrous for a high-end software company. The core concept is contextualization. You must analyze ratios by comparing them to industry benchmarks, direct competitors, and the company's own historical performance to identify trends and anomalies.

This analysis helps you understand a company's business model and competitive advantages. For example, high Return on Invested Capital (ROIC) might indicate a strong brand or proprietary technology, while a deteriorating Days Sales Outstanding (DSO) could signal issues with credit quality or collection processes.

Sample Question & Answer Walkthrough

Question: "Company A has a higher Return on Equity (ROE) than Company B. Does this automatically mean Company A is a better business?"

Answer:

"Not necessarily. While a higher ROE is often a positive sign, we need to decompose it using the DuPont analysis to understand what's driving it. ROE is a function of three things: Net Profit Margin (profitability), Asset Turnover (efficiency), and Financial Leverage (debt).

Check Profitability: Company A could simply be more profitable, with higher margins.

Check Efficiency: It might be using its assets more efficiently to generate sales, indicated by a higher Asset Turnover.

Check Leverage: Crucially, Company A could be using significantly more debt. High leverage magnifies returns, making ROE look good, but it also increases risk. If Company B has a lower but still strong ROE with much less debt, it might be the safer, more fundamentally sound investment.

Therefore, before concluding, I would analyze the components of ROE for both companies to see if the outperformance is driven by superior operations or just higher financial risk."

Pro Tip: Always have a few industry-specific examples ready. For instance, you could compare the high margins and ROIC of a tech company like Apple to the high-volume, low-margin model of a retailer like Costco to demonstrate your understanding of how business models drive financial metrics.

10-Point Investment Banking Technical Comparison

Topic | 🔄 Complexity | ⚡ Resources & Prep | 📊 Expected Outcomes | 💡 Ideal Use Cases | ⭐ Key Advantage |

|---|---|---|---|---|---|

Three Financial Statements (Income Statement, Balance Sheet, Cash Flow Statement) | 🔄 Foundational — low structural complexity | ⚡ 5–10 hrs; basic Excel + accounting (GAAP/IFRS) | 📊 Clear linkage of profit, position, and cash; foundation for valuation | 💡 Entry-level interviews, valuation fundamentals, financial analysis primer | ⭐ Core financial literacy; broadly expected |

DCF Valuation Model with Sensitivity and Scenario Analysis | 🔄 Intermediate → Advanced — complex assumptions & math | ⚡ 15–30 hrs; detailed forecasting, WACC inputs, Monte Carlo (optional) | 📊 Intrinsic value range with sensitivity & scenario insight | 💡 Buy-side/IB valuation, deal diligence, deep investment analysis | ⭐ Theory-driven, stress-testable valuation |

Comparable Company Analysis (Comps Analysis) | 🔄 Intermediate — data selection and adjustment work | ⚡ 8–12 hrs; market data (Bloomberg/CapIQ), peer screening | 📊 Market-implied valuation range using trading multiples | 💡 Quick sanity checks, pitchbooks, public comps benchmarking | ⭐ Market-based, fast to explain and defend |

Precedent Transactions Analysis (Accretion/Dilution Analysis) | 🔄 Intermediate — transaction matching and adjustments | ⚡ 10–15 hrs; M&A databases, deal document review | 📊 Deal-based price indications and accretion/dilution impacts | 💡 M&A negotiation support, deal pricing, strategic buy-side work | ⭐ Reflects actual prices paid including control premiums |

LBO (Leveraged Buyout) Model and Analysis | 🔄 Advanced — multi-layered debt schedules and returns math | ⚡ 25–40 hrs; detailed model building, debt/interest mechanics | 📊 Projected PE returns (MOIC, IRR) across hold scenarios | 💡 Private equity underwriting, sponsor diligence, buyout planning | ⭐ Captures leverage-driven return dynamics |

M&A Deal Structure, Financing, and Accounting Treatment | 🔄 Intermediate — technical accounting & tax nuances | ⚡ 8–12 hrs; tax/accounting knowledge, advisor inputs | 📊 Effects of structure on buyer/seller tax, balance sheet, and earnings | 💡 Structuring transactions, tax-efficient deal design, purchase accounting | ⭐ Practical mechanics for executing and evaluating deals |

WACC Calculation and Cost of Capital Components | 🔄 Intermediate — input estimation and judgment calls | ⚡ 6–10 hrs; market rates, beta sourcing, debt terms | 📊 Discount rate for valuation; sensitivity to capital structure | 💡 DCF valuation input, capital structure analysis, project appraisal | ⭐ Standardized measure tying risk to required returns |

Credit Analysis and Credit Metrics Interpretation | 🔄 Intermediate — ratio analysis plus covenant/structure review | ⚡ 8–12 hrs; debt schedules, covenant language, industry benchmarks | 📊 Assessment of serviceability, refinancing risk, and rating signals | 💡 Lending decisions, DCM, bond investing, risk monitoring | ⭐ Quantitative view of default/refinancing risk |

IPO Process, Valuation, and Going Public Mechanics | 🔄 Intermediate — regulatory and market-process complexity | ⚡ 6–10 hrs; SEC rules (S‑1), investor roadshow knowledge | 📊 Pre-IPO valuation, pricing mechanics, and market debut dynamics | 💡 ECM advisory, corporate planning for going public, IPO execution | ⭐ Practical knowledge of how public market access is achieved |

Financial Ratios, Profitability Analysis, and KPI Interpretation | 🔄 Foundational — straightforward calculations | ⚡ 6–8 hrs; financial statements and peer data | 📊 Quick signals on profitability, efficiency, liquidity, returns | 💡 Initial screening, trend analysis, peer comparisons | ⭐ Standardized, easy-to-communicate performance benchmarks |

From Preparation to Performance: Your Next Steps to an Offer

Navigating the landscape of investment banking technical questions can feel like preparing for a final exam and a high-stakes performance all at once. This guide has dissected the core concepts that form the bedrock of an analyst's toolkit, from the foundational three financial statements to the complex mechanics of an LBO model and the nuances of M&A accounting. We have broken down DCF valuation, Comparable Company Analysis, and Precedent Transactions, not just as academic exercises, but as the practical valuation methodologies you will be expected to discuss with fluency.

The journey, however, doesn't end with understanding these topics in isolation. The true test in an interview is not just reciting a definition but connecting the dots. It’s about explaining how a change in an assumption for the Cost of Equity in your WACC calculation impacts the implied valuation from your DCF, or how a company's credit metrics might influence its viability as an LBO target. Interviewers are assessing your ability to think like a banker, which means synthesizing information and communicating complex ideas with clarity and confidence.

Key Takeaway: Mastery isn't just knowing the "what" behind each technical question; it's about deeply understanding the "why" and articulating the "how" under pressure. Your goal is to move from rote memorization to internalized, logical reasoning.

Bridging the Gap from Knowledge to Fluency

The most significant hurdle for many candidates is transitioning from passive learning to active application. Reading about an accretion/dilution analysis is one thing; articulating the precise impact of different financing structures on EPS in a live interview is another entirely. This is where deliberate, targeted practice becomes non-negotiable. Merely re-reading notes or watching videos creates a false sense of security. To truly excel, you must simulate the interview environment.

Here are your actionable next steps to convert your preparation into a compelling performance:

Build from Scratch: Don't just review completed models. Open a blank Excel sheet and build a simple DCF. Then, build a basic LBO. This hands-on practice forces you to confront every formula and assumption, solidifying your understanding far more effectively than passive review.

Verbalize Your Logic: Practice answering investment banking technical questions out loud. Record yourself explaining how to walk through the three financial statements or the steps of an IPO process. This uncovers gaps in your explanations and builds the muscle memory required for articulate delivery.

Connect Concepts: Create a mind map or a flowchart that links the topics covered in this article. For example, draw a line from WACC to DCF Valuation, and another from EBITDA multiples (found in Comps) to an LBO model's entry valuation. This visual connection reinforces how these concepts interrelate in real-world scenarios.

Embrace Repetition: Your recall needs to be instant. An interviewer won't wait 30 seconds while you try to remember a formula. The only way to achieve this speed is through consistent drilling. Focus on your weakest areas until the answers become second nature.

The Final Mile: From Prepared to Polished

Ultimately, interviewers are looking for candidates who demonstrate not just intelligence, but also composure, precision, and a genuine enthusiasm for the mechanics of finance. Mastering the technicals is your ticket to the game; it proves you have the intellectual horsepower and dedication required for the job. By investing in a structured and active practice regimen, you aren't just learning answers. You are building the confidence to handle any question thrown your way, showcasing the analytical rigor and poise that separates a good candidate from a future hire.

Ready to turn theory into interview-winning performance? AskStanley AI provides an AI-powered mock interviewer that drills you on the exact investment banking technical questions covered in this guide, giving you instant feedback to perfect your answers. Start your personalized training and walk into your next interview with unshakeable confidence at AskStanley AI.