Walk Me Through the 3 Financial Statements - Explained Simply

Walk Me Through the 3 Financial Statements - Explained Simply

If you’ve ever prepped for an investment banking, private equity, or even consulting interview, you’ve definitely heard this question before:

“Walk me through the three financial statements.”

It sounds basic, but it’s one of the most important questions in finance interviews. How you answer says a lot about how well you actually understand how a business works. Here’s how to break it down.

Today, we are using AskStanley to work through this question:

AskStanley-simplified summary of “walk me through the three financial statements”

1. Income Statement

The income statement shows how much money a company made or lost over a specific period – usually a quarter or a year.

It starts with revenue (sales), then subtracts:

Cost of goods sold (COGS) → gives you gross profit

Operating expenses (like SG&A or R&D) → gives you operating income (EBIT)

Interest and taxes → leaves you with net income, the company’s bottom line

In short, the income statement answers one question:Did the company make a profit?

2. Balance Sheet

The balance sheet is a snapshot in time showing what the company owns and owes.

It’s built around one simple formula:Assets = Liabilities + Shareholders’ Equity

Assets – what the company owns (cash, inventory, property)

Liabilities – what it owes (debt, accounts payable)

Equity – what’s left for shareholders after debts are paid

The balance sheet shows the company’s financial position on a specific date — what it looks like “right now.”

3. Cash Flow Statement

The cash flow statement tracks how cash actually moves through the business.

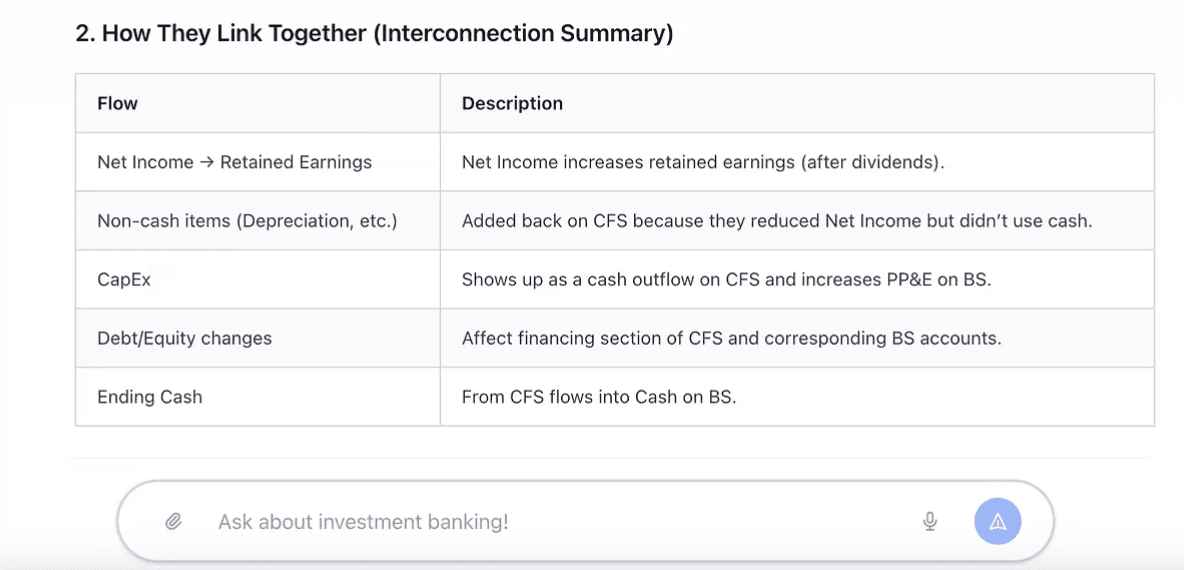

It starts with net income from the income statement and adjusts for:

Non-cash items (like depreciation)

Changes in working capital

Then it breaks cash activity into three sections:

Operating activities – day-to-day business cash flow

Investing activities – buying or selling assets

Financing activities – raising or repaying capital (debt, equity, dividends)

This statement answers:Where did the cash come from — and where did it go?

Common Follow Up Questions

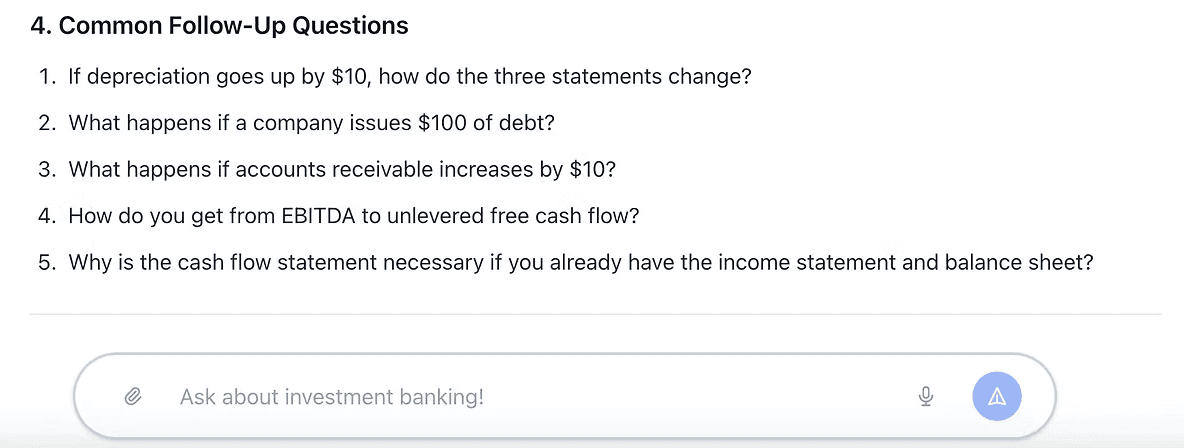

Once you’ve nailed the “walk me through the three statements” question, interviewers often push further. They’ll test whether you understand how the statements connect — things like what happens if depreciation goes up or if a company issues new debt.

That’s where Stanley comes in. It doesn’t just give you the answer, it helps you understand the logic behind it. From linking net income to cash flow to explaining balance sheet adjustments, Stanley walks you through the why, not just the what.

AskStanley-generated: common follow up questions after a 3 statement walkthrough

Want more practice mock interviewing, working through drills, or more? Try AskStanley.ai – your personal AI investment banking prep partner. Built by analysts who’ve actually been through the grind