Your Definitive Private Equity Interview Guide for Success

Your Definitive Private Equity Interview Guide for Success

Getting a job in private equity isn't just about acing a test. It's about proving you have the mind of an investor. The whole interview process is designed to find that out. This guide will walk you through the entire gauntlet, from learning the fundamentals to crushing your final superday.

Cracking the Code of Private Equity Recruiting

Welcome to your complete roadmap for private equity interviews. Landing a seat at a PE fund is less about luck and more about a relentless, strategic preparation process. The bar is incredibly high for a reason—firms aren't just hiring analysts; they're looking for future partners who will one day manage billions of dollars. They need people with a rare blend of technical precision, sharp commercial judgment, and serious resilience.

That intensity shows up in the numbers. In the hyper-competitive world of PE, top mega-funds like Blackstone or KKR reportedly get over 10,000 applications for a single associate spot. That puts acceptance rates well below 1%. For undergrads trying to break in directly, it's even tougher, with some estimates putting the odds around 0.5% even for students from top-tier schools. You can dig into more of these PE recruiting statistics to see just how fierce the competition is.

Understanding the Interview Gauntlet

The private equity interview process is a multi-stage marathon designed to test you from every possible angle. It usually unfolds in a few increasingly difficult rounds:

Initial Screening: This is usually a quick chat with a headhunter or an internal HR person. They're checking boxes: your background, your resume, and why you're interested in PE.

First-Round Interviews: Here's where the technical grilling starts. You'll likely talk to associates or VPs and get hit with paper LBOs, accounting questions, and quick-fire technicals.

Case Study: This is the big one. You'll get a timed case study, either on the spot or as a take-home model. The goal is to analyze a potential investment, build a model, and defend your recommendation.

Superday: The final round. You'll face a series of back-to-back interviews with senior people, including Partners. Expect a mix of everything: advanced technicals, deep dives into every deal on your resume, and intense behavioral and "fit" questions.

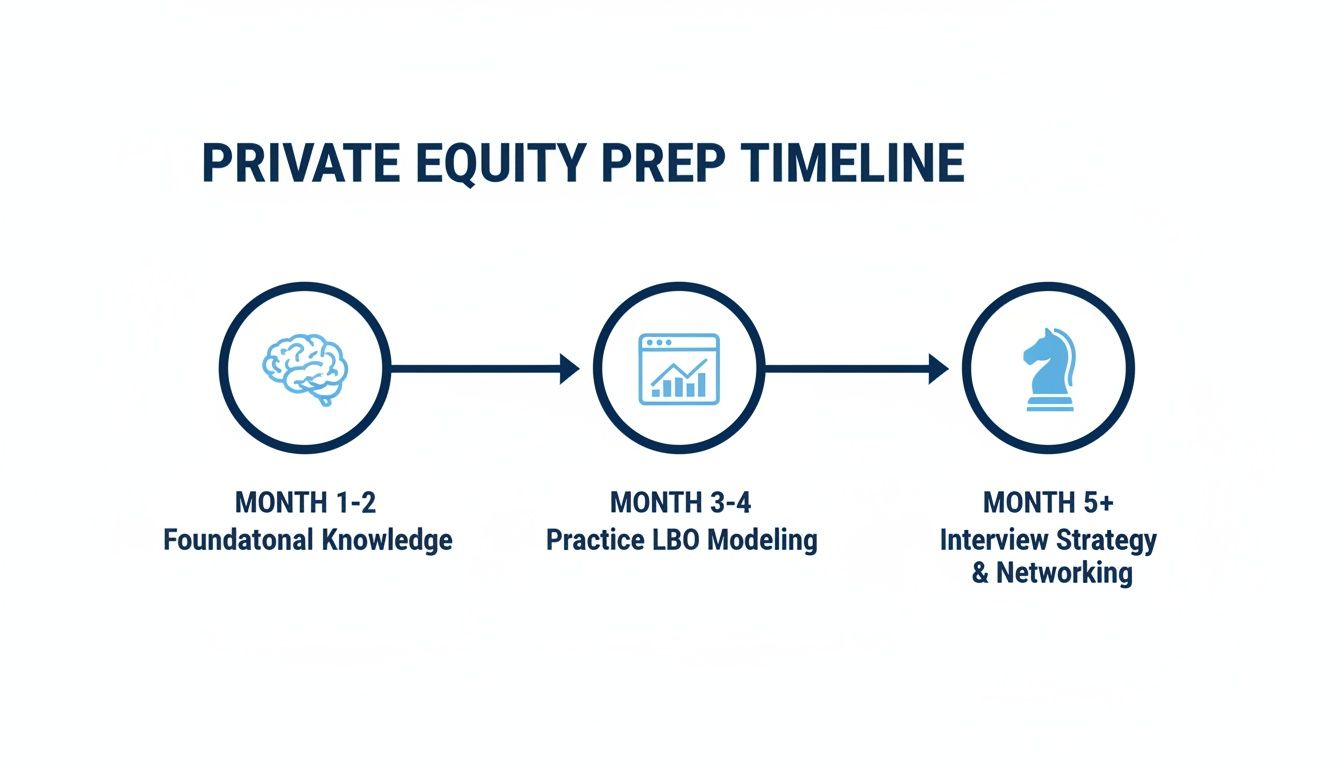

The timeline below gives you a high-level look at how to structure your prep. It’s all about building your skills progressively, from the ground up.

This isn’t just about memorizing facts. Success comes from a structured approach that lets you build knowledge methodically, so you can apply it under pressure when it really counts.

A structured plan is your best defense against the intensity of the PE recruiting cycle. The table below breaks down a realistic timeline to get you from zero to interview-ready.

Private Equity Interview Preparation Timeline

A structured timeline to guide your preparation, from foundational knowledge to advanced practice.

Phase | Timeframe (Pre-Interview) | Key Focus Areas | Recommended Actions |

|---|---|---|---|

Phase 1: Foundation | 12-8 Weeks Out | Firm Research, Accounting, Valuation Basics | Identify 10-15 target firms. Master the 3 financial statements and core valuation methods (DCF, Comps, Precedents). |

Phase 2: Technical Deep Dive | 8-4 Weeks Out | LBO Modeling, Deal Walkthroughs | Build LBO models from scratch until it's second nature. Craft and refine your deal stories. |

Phase 3: Strategy & Practice | 4-1 Weeks Out | Case Studies, Behavioral Questions, Mock Interviews | Complete at least 3-5 full case studies under timed conditions. Practice behavioral answers and schedule 5-10 mock interviews. |

Think of this timeline as a framework, not a rigid set of rules. The key is to be honest about your weak spots and allocate your time accordingly. If your accounting is shaky, spend more time in Phase 1. If you're a modeling wizard but struggle to articulate your thoughts, double down on mock interviews in Phase 3.

Mastering the Technical Interview Gauntlet

Let’s be blunt: your technical skills are the price of admission. You can be the most personable candidate in the world, but if you can’t nail the core financial concepts, your interview process will be short. This isn’t about memorizing formulas; it's about thinking like an investor who’s about to write a nine-figure check.

This is your technical boot camp. We'll focus on what actually matters on the job.

Demystifying the Leveraged Buyout Model

The Leveraged Buyout (LBO) is the engine of private equity. At its core, it’s just buying a company with a lot of borrowed money. The PE fund puts in some of its own cash (equity) and finances the rest with debt.

Think of it like buying a rental property. You don't show up with a briefcase full of cash for the whole house. You make a down payment (your equity) and get a mortgage (the debt). The goal? Use the rent checks to pay down that mortgage, cover your costs, and eventually sell the property for a nice profit.

In an LBO, the company's own cash flow is the "rent check" used to pay down the acquisition debt. The PE firm spends the next 3-5 years trying to make the business more profitable before selling it for more than they paid.

An LBO's success really boils down to three levers you can pull:

Deleveraging: The simplest one. The company’s cash flow pays down debt, which means the equity slice of the pie gets bigger, all else being equal.

EBITDA Growth: This is where the operational magic happens. You cut costs, launch new products, or find smarter ways to grow revenue to make the business more profitable.

Multiple Expansion: Selling the company for a higher valuation multiple (like EV/EBITDA) than you bought it for. This one is the trickiest and often depends on market timing.

Key Takeaway: An LBO model isn't just a spreadsheet exercise. It's a dynamic tool to stress-test an investment idea. It tells you the absolute maximum price you can pay for a business and still hit your target return, which is typically a 20-25% Internal Rate of Return (IRR).

Valuation from a Buyer’s Perspective

Valuation methods like DCF and Comps are bread-and-butter in any finance role. The difference in PE is your mindset. You aren't just calculating a theoretical "fair value." You're figuring out what you, a buyer, should actually pay.

Discounted Cash Flow (DCF): This is all about what a company is worth based on its own ability to spit out cash in the future. It’s the intrinsic, fundamental value.

Comparable Company Analysis: You're looking at similar public companies to see what the market thinks they're worth. This gives you a feel for what the company might be valued at when you eventually sell it.

Precedent Transaction Analysis: This is arguably the most relevant method. You're looking at what buyers have actually paid for similar companies in the past. It’s valuation based on real deals, not just theory.

An investment banker uses these tools to argue for the highest possible price for their client. A PE professional uses them to find the floor—the most you can pay and still make the deal work for your fund. For a deeper dive, our guide on https://www.askstanley.ai/articles/investment-banking-technical-questions is a fantastic primer that’s directly applicable here.

Connecting the Three Financial Statements

If you don't have an intuitive grasp of how the three financial statements link together, you're done. Interviewers will poke and prod at this until they're sure you get it.

Let's trace a simple transaction: a company buys a $100 piece of equipment with cash.

Statement of Cash Flows: Cash from Investing goes down by $100 (a cash outflow for a capital expenditure). This lowers your ending cash balance.

Balance Sheet: Cash (an asset) is down by $100. But Property, Plant & Equipment (PP&E), another asset, goes up by $100. The sheet stays balanced.

Income Statement: Nothing happens on day one. But in the next period, depreciation on that new equipment hits the income statement as an expense, lowering your net income.

You need to be able to do this in your sleep for any transaction, from issuing debt to a change in inventory. It shows you understand the financial plumbing of a business, which is the absolute foundation for building a credible financial model.

Crafting Your Deal and Firm Narratives

Technical chops get your resume in the door. But your ability to tell a compelling story about your experience is what actually gets you the job.

Every single interviewer will ask you to walk them through a deal. This isn't a memory test. It's a live audit of your investment judgment. They want to know if you can think like an owner—a principal—not just an advisor executing a checklist.

A sharp, well-told narrative shows you understand the entire investment lifecycle, from the initial idea to the final outcome.

Structuring Your Deal Walkthrough

The best way to structure your deal story is to adapt the classic STAR method (Situation, Task, Action, Result). It’s a simple framework that forces you to be logical, concise, and hit all the key points your interviewer is listening for.

Think of every deal on your resume as a potential story. You need at least two ready to go: one that was a home run, and another where you can talk intelligently about what went wrong and what you learned from it.

Here’s how to apply the STAR method to your deal:

Situation: Set the scene, quickly. What was the company, what does it do, and what was the transaction? (e.g., a sell-side process for a founder-owned software business).

Task: What was your specific role? Did you own the operating model? Were you in charge of the data room and diligence requests? Get specific.

Action: This is the heart of your story. What specific analyses did you run? Talk about the key diligence findings, the main drivers of the valuation, and any big debates or challenges that came up.

Result: What happened? Did the deal close? More importantly, what was your personal takeaway? What did you learn that you’ll apply to the next deal?

Pro Tip: Don't just list facts; explain the "so what." Instead of saying, "We did market research," try: "Our market research showed the industry was extremely fragmented, which created a compelling roll-up opportunity. That became a core pillar of our investment thesis."

Anticipating the Tough Questions

A great deal walkthrough sounds like a conversation, not a monologue. It should invite follow-up questions. Your interviewer is going to poke and prod at your logic to see how deep your understanding really goes.

Be ready to defend every assumption. You should expect questions like:

What were the 3 biggest risks you found in diligence? How did you get comfortable with them?

If you could go back, what’s one piece of diligence you would have done differently?

Looking back now, was this a good investment? Why or why not?

What were the primary levers you modeled for creating value after the deal closed?

The goal is to prove you thought critically about the business, far beyond the numbers on a spreadsheet. This is a non-negotiable part of any solid private equity interview guide.

Researching the Firm Beyond the Homepage

Just like you need a story for each deal, you need one for why you want to work at their specific firm. A generic answer is an instant killer. You have to go deeper than their "About Us" page.

Start by digging into their current portfolio. Pick two or three companies that you find genuinely interesting. Figure out their investment thesis for each one. Why did they buy it? What kind of value are they trying to create?

Then, decode their strategy:

Sector Focus: Are they generalists, or do they only play in specific sandboxes like healthcare, software, or industrials?

Deal Size: Do they hunt for lower middle-market companies, middle-market platforms, or mega-cap take-privates?

Investment Style: Are they known for operational turnarounds? Growth equity checks? Complex roll-up strategies?

This is how you build a real, compelling answer to the "Why this firm?" question. It shows you’ve done the work and separates you from the crowd giving canned, boring responses. The final step is using this research to ask them smart questions, which is how you make a lasting impression.

How to Decode the Private Equity Case Study

The technicals prove you can do the math. The deal walkthrough shows you can tell a story. But the case study? That's your live audition.

This is where the firm puts you under the microscope to see if you can think, act, and make decisions like a real private equity investor when the pressure is on. It’s a holistic test of your commercial judgment, analytical horsepower, and communication skills all rolled into one. Nailing the case study is often the single biggest factor that separates an offer from a rejection.

The Two Flavors of Case Studies

Case study prompts can vary, but almost all of them fall into one of two buckets. Figuring out which one you’re facing is the first step to crushing it.

The Paper LBO: This is a rapid-fire test, usually done on the spot in 30 to 90 minutes. You'll get a short description of a company and have to build a simple LBO model on paper or a whiteboard—no computer. The goal isn’t perfect math; it’s about making smart assumptions on the fly to see if a deal is even in the ballpark.

The Full Investment Memo: This is the more in-depth, take-home version. You’ll typically get a 2 to 4-hour time limit (sometimes overnight) and a much thicker packet of information. The expectation is a functional model, some outside research, and a short presentation arguing your investment recommendation.

No matter the format, your job is the same: land on a clear "invest" or "pass" call and be ready to defend it. For a deeper dive, check out our complete guide on how to prepare for case study interviews.

A Framework for Structuring Your Analysis

When the clock starts, your first instinct might be to dive headfirst into Excel. Don't. Panic is the enemy of clear thinking. A structured approach is your best friend—it ensures you cover all your bases and build a logical argument.

Think of your analysis like a funnel, starting broad and getting progressively more detailed. A solid framework looks something like this:

Investment Merits: What makes this a potentially great business? Find 3-5 core strengths. Think strong market position, recurring revenue, fat margins, or a deep competitive moat.

Key Risks & Mitigants: What keeps you up at night about this deal? Identify the biggest red flags—customer concentration, a cyclical industry, tech disruption—and, most importantly, suggest how you’d manage them.

Value Creation Levers: You're the new owner. How are you going to make this company better? Lay out specific operational fixes, M&A ideas, or plans for market expansion.

Financial Analysis & Returns: Now it’s time for the model. Project out the financials and calculate the key return metrics (IRR and MOIC) for your base, upside, and downside scenarios.

Final Recommendation: Tie it all together. Deliver a decisive "invest" or "pass" conclusion, backed by everything you just analyzed.

A classic mistake is spending 90% of your time building the perfect model and only 10% on the story. The best candidates flip that. They use the model to support a compelling investment narrative, not the other way around.

Beyond the Numbers: Presenting Your Case

Your analysis could be brilliant, but if you can’t communicate it clearly, it won’t matter. The goal here is to present with the confidence of a partner pitching the investment committee. Lead with your answer.

Kick it off with a direct, confident statement: "I recommend we invest in Company X, and here are the three main reasons why." This sets the tone immediately and shows you can form a strong, data-backed opinion.

From there, walk them through your framework, hitting on the key merits and risks. Be ready for them to jump in and poke holes in every single assumption you made. This isn't a bad sign; it’s a stress test. They want to see how you think on your feet and handle intellectual sparring. The best case studies feel less like a presentation and more like a dynamic debate.

Answering Behavioral Questions to Prove Your Fit

Technical skills will get you in the door for a private equity interview. That's the price of admission. But what gets you the offer? It’s your fit—the blend of your investor mindset, raw resilience, and commercial instincts. Behavioral questions are designed to dig into exactly that, going way beyond your resume to see how you actually think under pressure.

Firms aren't just hunting for someone who can build a perfect LBO model. They’re looking for a future partner. Someone with an obsessive focus on driving returns for investors, an intense curiosity about how businesses work, and the grit to survive the industry’s brutal hours and high-stakes environment.

The Real Question Behind the Question

Every behavioral question is a test for something deeper. "Why Private Equity?" isn't a casual inquiry about your career path; it's a test of your commitment and whether you truly understand what you're signing up for. "Why our firm?" is their way of asking if you've done real homework or just skimmed their website's homepage.

To give a great answer, you need to connect your personal story directly to the demands of the job.

Ambition and Drive: Your story has to scream "investor," not "advisor." It’s about wanting ownership, about having skin in the game.

Resilience: Talk about a time you got knocked down—hard—in a professional or academic setting and how you got back up. This shows them you can handle the constant setbacks of deal-making.

Commercial Instinct: Show them you think like a business owner, not a spreadsheet jockey. Weave in your thoughts on market trends, competitive moats, and what actually creates value for a company.

A powerful answer isn’t a rehearsed script. It’s a genuine story from your past that proves you have the right mindset. It tells the interviewer not just what you did, but how you think.

If you’re coming from banking, framing your experience is key. Our guide on investment banking behavioral questions is a great starting point for structuring these kinds of stories.

Common Behavioral Questions and Answer Framework

The best answers are structured, not scripted. You need a framework that lets you hit the key points without sounding like you're reading from a teleprompter. Here’s a quick guide to what they're really asking and how to frame your response.

Question | What They're Really Asking | Effective Answer Structure |

|---|---|---|

Why Private Equity? | Do you truly understand this job? Are you ready for the long-term commitment of being an investor? | 1. The Spark: What initially drew you to investing? 2. The Banking Bridge: How did your advisory role confirm your desire to take ownership? 3. The Future: Why is PE the only logical next step? |

Why Our Firm? | Have you done your homework? Can you articulate a specific, compelling reason you belong here? | 1. The Strategy: Show you understand their unique investment thesis (e.g., sector focus, operational approach). 2. The Deal: Reference a specific deal and explain why you found it compelling. |

Walk Me Through a Deal. | Can you think critically about a business and articulate its investment merits and risks concisely? | 1. The "What": Briefly describe the business and the deal context. 2. The "Why": Explain your role and the strategic rationale. 3. The "So What": Discuss key drivers, risks, and your key takeaways. |

Tell Me About a Failure. | Are you self-aware? Can you take ownership of mistakes and learn from them without making excuses? | 1. The Situation: Briefly set the scene. 2. The Mistake: Clearly state what you did wrong. 3. The Lesson: Explain exactly what you learned and how you applied that lesson later. |

Remember, the goal is to tell a compelling story that showcases your investor DNA. Use this framework to make sure your experiences hit all the right notes.

Answering the Unspoken Questions

Beyond the standard questions, interviewers are quietly sizing you up. They're asking themselves, "Do I want to be stuck in a conference room with this person at 2 a.m. working on a deal?" This is where your personality and energy become a huge differentiator.

The current market makes this even more critical. Private equity is shifting toward high-conviction bets where deep operational knowledge is everything. In Q3, deal values shot up 42.6% year-over-year to $258.52 billion, even as the number of deals fell. This trend, detailed in a recent global private equity transaction report from S&P Global, means firms are hungry for specialists—roughly 60% are prioritizing deep industry expertise. Your answers need to show you're not just a finance generalist.

To nail the "fit" part, you absolutely must demonstrate:

Genuine Curiosity: Ask smart, thoughtful questions about their portfolio companies, their strategy, and recent deals. This proves you're not just going through the motions.

Coachability: Show you can take feedback and are hungry to learn. A "know-it-all" attitude is the fastest way to get dinged.

Positive Energy: An interview day can be a marathon. Stay engaged, lean in, and show some enthusiasm. They are testing your stamina.

In the end, your behavioral performance boils down to being authentic and being prepared. Know your story cold, understand the firm's game plan, and connect the two with real conviction. That’s how you prove you don’t just want a job—you belong there as an investor.

Gaining Your Competitive Edge with AI-Powered Prep

Prepping for a private equity interview used to feel like climbing a mountain with an old, tattered map. You’d grind through static PDF guides, memorize questions from a list, and just hope you covered the right ground. That whole approach is reactive and full of guesswork, leaving you totally flat-footed in the high-stakes reality of a superday.

Things have changed. Modern tools offer a much smarter, more direct way to get ready. A purpose-built AI platform like AskStanley becomes your personal training partner, turning passive reading into an active, adaptive process. Instead of just reviewing LBO mechanics, you can run an infinite number of technical drills that force you to actually apply the concepts under pressure.

Pinpoint Weaknesses with Precision Analytics

The biggest problem with studying on your own is figuring out what you don’t know. You might feel solid on valuation but have a massive blind spot when it comes to debt covenants. AI-powered prep cuts through that uncertainty by tracking your performance across thousands of data points.

This screenshot from AskStanley shows how the platform organizes your entire prep workflow, from technical drills to networking.

The dashboard gives you instant, actionable feedback. It highlights the specific areas—like calculating IRR or thinking through a deal's key risks—where you need to spend more time. This lets you focus your limited study hours with surgical precision instead of just guessing.

Simulate Real-World Interview Pressure

Reading about a case study is one thing. Presenting your findings to a partner who is actively trying to poke holes in your logic is something else entirely. AI-powered mock interviews are built to simulate that exact environment.

You get realistic, pressure-tested scenarios that mirror the intensity of a final round. The AI provides immediate feedback on not just the substance of your answers but also on your structure and delivery, helping you build the confidence to perform when it counts.

The market has never been more demanding. Private equity interviews in 2025 are a pressure cooker of technical skill and market savvy. Undergrads from over 250 schools are already using platforms like AskStanley to track their weaknesses across more than 150,000 drills, mastering metrics like strategic buyer exits, which have doubled in value.

Understanding current market dynamics—like the fact that dry powder is down 10% while exit values jumped 69.3% in H1—is crucial for a complete interview prep. You can dig into insights like these in the latest global private equity report from KPMG. This is what transforms prep from guesswork into a targeted strategy.

Your Top Private Equity Interview Questions, Answered

As you get closer to the finish line of your interview prep, a few nagging questions always seem to pop up. Let's clear the air on some of the most common uncertainties so you can focus your final push where it really counts.

How Much Technical Knowledge Is "Enough"?

You need to have LBO modeling, valuation (DCF, Comps), and the core accounting principles down cold. But this isn't about memorizing flashcards. The real test is whether you can use these tools to actually analyze a business and decide if it's a good investment.

The bar is high: you should be able to build a simple LBO model from scratch, live in an interview, and talk through the key return drivers without breaking a sweat.

What's the Single Biggest Mistake Candidates Make?

By far, the most common mistake is failing to think like an investor. I’ve seen countless candidates who can walk through a deal they worked on with perfect detail—what they did, the steps they followed—but completely fall apart when asked why it was a good or bad investment.

They can't articulate the real risks, how an owner could create more value after buying the company, or what they would have done differently. You have to make the mental shift from being an advisor who completes tasks to a principal who owns the outcome.

Always frame your experience through an investor's lens. It's not about the process you followed; it's about the investment judgment you developed. This shift in perspective is what separates top candidates from the rest.

Just How Important Is Networking for Recruiting?

It's everything. Unlike the big, structured recruiting pipelines in other industries, breaking into private equity is often an accelerated, relationship-driven game. Just submitting your resume through an online portal is a surefire way to get lost in the crowd.

You need to be building real connections with headhunters and people at your target firms long before the official process kicks off. These relationships give you insight into a firm's culture and what they’re looking for, and they dramatically increase your odds of even getting that first-round interview.

Should I Have a Specific Industry Focus?

For junior roles at generalist funds, it's not a hard-and-fast rule. But having a clear interest or some real expertise in a specific sector is a massive advantage. It changes the entire dynamic of your conversations.

Instead of just talking about generic financial metrics, you can get into the weeds on a firm's portfolio companies and discuss real market trends with conviction. It shows you have commercial sense and a genuine passion for investing. It proves you’re not just looking for any PE job—you’re actively thinking about where the great deals are.

Ready to master the technical skills and investor mindset needed to win offers? AskStanley AI is built for this. Our platform gives you infinite technical questions, realistic mock interviews, and detailed feedback to find and fix your weak spots. Walk into your interviews with total confidence.

Start your journey here: https://www.askstanley.ai