8 Crucial Investment Banking Case Studies to Master in 2025

The investment banking interview process is a gauntlet, designed to test not just what you know, but how you think under pressure. Beyond the technical questions and "fit" interviews, the case study is where you prove your mettle. It's the closest you'll get to a real-life analyst or associate task, demanding a blend of financial modeling skill, strategic thinking, and structured communication. This is where firms separate the prepared candidates from the rest.

This guide breaks down the most critical types of investment banking case studies you'll face, moving beyond surface-level descriptions to provide the deep analytical frameworks and actionable tactics needed to deliver a compelling, offer-winning solution. We provide a replicable process for each scenario, showing you exactly how to structure your thinking, build your model, and present your recommendation with confidence.

You will gain a strategic advantage by learning how to:

Structure Your Analysis: Deconstruct complex prompts into a clear, logical workflow.

Identify Key Drivers: Pinpoint the critical assumptions that shape the outcome of a model.

Communicate Insights: Articulate your findings and recommendations like a seasoned banker.

We will explore everything from classic Mergers & Acquisitions (M&A) and Leveraged Buyout (LBO) models to more nuanced scenarios like distressed M&A and dividend recapitalizations. Consider this your playbook for turning a challenging interview prompt into a clear, confident, and correct answer. We will equip you with the tools to master these investment banking case studies and demonstrate that you have what it takes to excel on the desk from day one.

1. Mergers & Acquisitions (M&A) Valuation Analysis

M&A valuation analysis is the cornerstone of many investment banking case studies and real-world transactions. It involves determining the fair value of a target company to advise an acquirer on a suitable offer price, deal structure, and potential synergies. This process is fundamental because it directly impacts whether a deal creates or destroys value for the acquirer's shareholders.

Analysts typically build a comprehensive valuation model using several methodologies to triangulate a credible price range. The most common techniques include Discounted Cash Flow (DCF), Comparable Company Analysis (Comps), and Precedent Transaction Analysis. Each method provides a different perspective on value, and a skilled analyst knows how to weigh them based on the specific industry and deal context.

The Interview Prompt & Solution Walkthrough

A classic M&A case study might ask you to advise a hypothetical client, like a large tech firm, on acquiring a smaller, high-growth software company. You would be expected to build a valuation, assess the strategic rationale, and recommend a bid price.

Your step-by-step approach should be methodical:

Understand the Business: Analyze the target's business model, market position, and growth drivers.

Build a DCF: Project the target's unlevered free cash flows for 5-10 years, calculate a terminal value, and discount these cash flows back to the present using the Weighted Average Cost of Capital (WACC). This requires a solid grasp of core accounting and finance principles.

Perform Relative Valuation: Identify a peer group of publicly traded companies (for Comps) and recent M&A deals (for Precedents). Calculate relevant multiples like EV/EBITDA and P/E to establish a market-based valuation range.

Synthesize Findings: Consolidate the results from all methodologies into a "football field" chart to visualize the valuation range.

Analyze Synergies: Estimate potential cost savings (e.g., overlapping headcount) and revenue enhancements (e.g., cross-selling). Quantify their NPV and add it to the standalone valuation to determine the maximum price the acquirer can justify paying.

Key Takeaway: The goal isn't just to calculate a number. It's to build a compelling narrative, supported by data, that justifies your final recommendation. The best answers demonstrate commercial acumen by considering factors beyond the numbers, such as cultural fit and integration risk.

Common Pitfalls and Best Practices

Unrealistic Assumptions: Avoid overly optimistic growth rates or synergy estimates. Always ground your assumptions in historical data and industry research.

Ignoring a Method: Don't rely solely on a DCF. A robust analysis cross-references multiple valuation techniques to ensure the final recommendation is defensible.

This type of case study directly tests the technical skills you'll use daily as an analyst. To prepare, ensure your understanding of valuation is sharp. You can dive deeper into the core concepts by reviewing resources that cover the four types of technicals you will get asked in your investment banking interview.

2. Leveraged Buyout (LBO) Analysis

A Leveraged Buyout (LBO) analysis is a core component of many investment banking case studies, particularly those involving private equity clients. It assesses the feasibility of acquiring a company using a significant amount of borrowed money (debt), with the goal of selling it later for a substantial profit. The analysis centers on the acquirer's ability to use the target's own cash flows to service and pay down this debt over a holding period, typically 3-7 years.

This method is crucial for determining the potential returns for financial sponsors, measured by metrics like Internal Rate of Return (IRR) and Multiple on Invested Capital (MOIC). A successful LBO hinges on acquiring a company with stable, predictable cash flows that can support the new, heavier debt load.

The Interview Prompt & Solution Walkthrough

A common LBO case study asks you to determine if a private equity firm should acquire a mature industrial company and what price it could pay to achieve a target 20-25% IRR. You'll need to model the deal from entry to exit.

Your step-by-step approach should be structured:

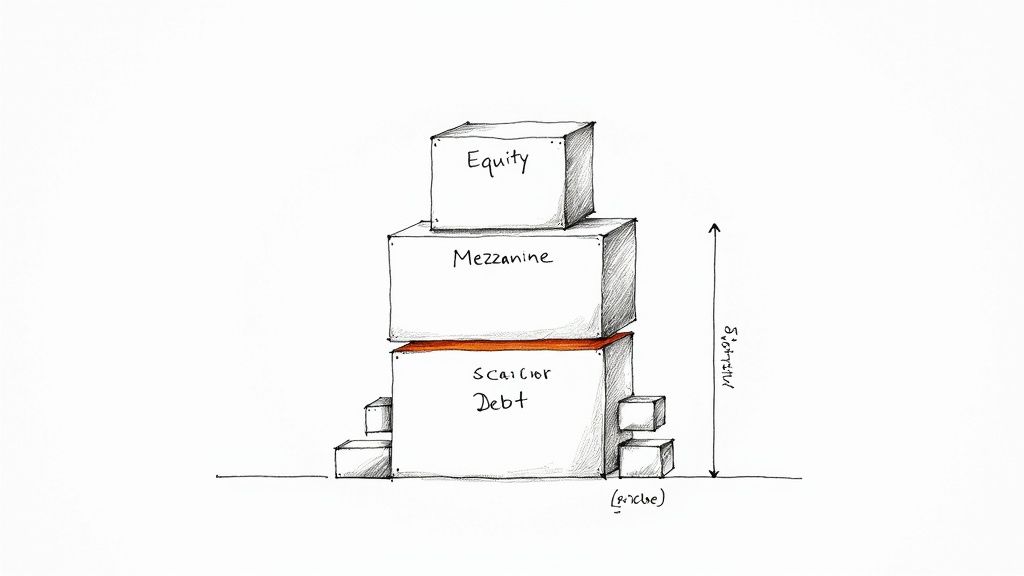

Determine Purchase Price & Financing: Establish assumptions for the purchase price (often based on an EBITDA multiple) and structure the financing with different tranches of debt and the sponsor's equity contribution.

Build a Financial Model: Project the company's three financial statements (Income Statement, Balance Sheet, Cash Flow Statement) over the holding period. This model must include a detailed debt schedule to track principal and interest payments.

Model the Exit: Assume the company is sold at the end of the holding period, typically based on a conservative EBITDA multiple similar to the entry multiple. Calculate the exit proceeds.

Calculate Returns: Determine the cash flows back to the equity sponsor after all debt is repaid. Use the initial equity investment and final proceeds to calculate the IRR and MOIC.

Run Sensitivity Analysis: Create tables showing how returns change based on different entry multiples, exit multiples, and leverage levels. This demonstrates a nuanced understanding of risk.

Key Takeaway: An LBO is a returns-focused analysis. Your recommendation isn't just about whether the target is a "good company," but whether it can generate the required returns under a specific, debt-heavy capital structure. The ability to articulate the key drivers of returns (leverage, EBITDA growth, and multiple expansion) is critical.

Common Pitfalls and Best Practices

Forgetting the Cash Sweep: Many LBO models use excess cash flow to pay down debt early (a "cash flow sweep"). Forgetting this understates returns and shows a lack of technical detail.

Static Operating Assumptions: A PE firm's thesis is often based on making operational improvements. Your model's projections should reflect this through margin expansion or revenue growth, but these must be well-justified.

LBO models are intricate and require a deep understanding of how financial statements are linked. To excel in these case studies, it is important to practice your foundational knowledge of key technical questions that frequently appear in interviews.

3. Initial Public Offering (IPO) Valuation & Pricing

An Initial Public Offering (IPO) is a critical juncture for a private company, and valuing it is a core task in many investment banking case studies. This process involves advising a company on the appropriate price at which to offer its shares to the public for the first time. The goal is to maximize the capital raised for the company while ensuring strong investor demand and a stable after-market performance, a delicate balance that defines the success of the IPO.

Bankers determine an appropriate valuation range using several methods, primarily Comparable Company Analysis (Comps) and Discounted Cash Flow (DCF) analysis. Unlike M&A, where precedent transactions are key, recent IPOs in the same sector often serve as a better benchmark. The final pricing is heavily influenced by market sentiment and feedback gathered during the investor roadshow, making it both an art and a science.

The Interview Prompt & Solution Walkthrough

A typical IPO case study will ask you to advise a fast-growing private tech company, like a fintech unicorn, on its upcoming IPO. You'll need to recommend a valuation range and outline the key steps and considerations in the IPO process.

Your step-by-step approach should demonstrate both technical and market-facing skills:

Position the Company: Analyze the company's competitive advantages, market size, and growth story to craft a compelling "equity story" for investors.

Select Comparables: Identify a set of publicly traded peers with similar business models, growth profiles, and financial metrics. Also, analyze the performance of recent, relevant IPOs.

Build the Valuation: Use Comps to derive valuation multiples (e.g., EV/Sales, P/E) and apply them to your company's financials. A DCF can also be used to establish an intrinsic value, but market-based methods are often more influential in IPO pricing.

Determine the Range: Synthesize your findings to propose an initial valuation range. This range is often presented with a 15-20% "IPO discount" to the intrinsic or comparable value to incentivize investors and encourage a first-day "pop."

Outline the Process: Discuss key milestones like the S-1 filing, the roadshow where management pitches to institutional investors, and the final book-building process to gauge demand.

Key Takeaway: An IPO valuation isn't just a technical exercise; it's a marketing and sales process. Your recommendation must be grounded in solid financial analysis but also account for market appetite, investor sentiment, and the narrative that will sell the company's stock.

Common Pitfalls and Best Practices

Ignoring Market Conditions: A great company can have a failed IPO in a bad market. Always factor in macroeconomic trends and overall market sentiment into your pricing recommendation.

Poor Comparable Selection: Choosing inappropriate peer companies can lead to a flawed valuation. Justify why each company in your comp set is a relevant benchmark.

Preparing for IPO case studies requires understanding how a company is positioned for public investors. You can build this commercial awareness by staying current on capital markets and reviewing investor presentations from recent IPOs.

4. Corporate Finance & Capital Raising

Corporate finance and capital raising cases are a core component of many investment banking case studies, testing your ability to advise a company on its optimal capital structure. This involves analyzing how a firm should fund its operations and growth, whether through issuing debt (like bonds) or equity (like new shares), to minimize its cost of capital while maintaining financial flexibility. This analysis is critical as it directly influences a company's valuation, risk profile, and ability to pursue strategic initiatives.

Bankers in this area must deeply understand a company's debt capacity, credit profile, and market conditions. They structure transactions that meet the client's funding needs, considering factors like interest rates, covenants, and investor appetite. The ultimate goal is to find the right balance between debt and equity that lowers the Weighted Average Cost of Capital (WACC) and maximizes shareholder value.

The Interview Prompt & Solution Walkthrough

A typical case study might ask you to advise a stable, cash-flow-positive industrial company on how to fund a major expansion. You would need to determine if it should issue new debt, raise equity, or use a hybrid instrument, and justify your recommendation.

Your step-by-step approach should be structured and logical:

Assess Current Capital Structure: Analyze the company's existing debt and equity mix. Calculate key leverage ratios like Debt/EBITDA and Debt/Equity and benchmark them against industry peers.

Determine Debt Capacity: Build a model to project future cash flows and determine how much additional debt the company can service without jeopardizing its credit rating. This involves stress-testing cash flows under different economic scenarios.

Analyze Funding Alternatives: Evaluate the pros and cons of each option. Debt is cheaper but adds financial risk (interest payments are mandatory). Equity is more expensive (dilutes ownership) but offers greater flexibility.

Model the Impact: Show how each funding scenario affects the company's financial statements, credit metrics, and WACC. A good analysis will model out the impact on earnings per share (EPS).

Formulate a Recommendation: Synthesize your findings and recommend the optimal funding strategy. This includes the type of instrument (e.g., senior notes, convertible bonds), the amount to raise, and the timing, considering current market conditions.

Key Takeaway: The best answers go beyond the mechanics of calculating WACC. They demonstrate a strategic understanding of how capital structure decisions align with the company's long-term business strategy, credit rating goals, and shareholder expectations.

Common Pitfalls and Best Practices

Ignoring Market Conditions: Failing to consider the current interest rate environment or investor demand for new issuances is a major oversight. A theoretically optimal solution might be impractical in the real world.

Neglecting Covenants: When recommending debt, you must consider the impact of potential financial covenants (e.g., leverage or interest coverage ratios) that could restrict the company's future operations.

This type of case challenges your understanding of how a company's operations and financing decisions are interconnected. A strong foundation in financial statements is essential to model these scenarios accurately. For a refresher, you can review this simple explanation of how to walk through the 3 financial statements.

5. Dividend Recapitalization & Special Dividends

A Dividend Recapitalization is a leveraged finance transaction where a company takes on new debt to pay a large, one-time "special" dividend to its equity holders. This is a common strategy for private equity firms looking to monetize a portion of their investment and lock in returns without selling the company. This type of investment banking case study tests your understanding of debt capacity, credit analysis, and shareholder return motives.

The core of the analysis is determining how much additional debt a company can sustainably support. Analysts must model the company's ability to service this new debt load through its cash flows while maintaining operational flexibility. It's a balancing act: maximizing the dividend payout for shareholders while ensuring the company doesn't become over-leveraged and risk financial distress.

The Interview Prompt & Solution Walkthrough

A typical case might present you with a portfolio company owned by a private equity sponsor. The prompt would be: "Advise the sponsor on the feasibility and optimal size of a dividend recapitalization." You would need to assess the company's financial health and market conditions to make a recommendation.

Your step-by-step analysis should include the following:

Assess Current State: Analyze the company's historical financial performance, existing debt structure, and key credit metrics (e.g., Net Debt / EBITDA, EBITDA / Interest Expense).

Determine Debt Capacity: Identify comparable companies and recent dividend recap transactions to find a target leverage multiple (e.g., a "pro forma" Net Debt / EBITDA). This is the key driver of the transaction size.

Model the Transaction: Build a "Sources & Uses" table. The primary "Use" of funds is the special dividend, while the "Source" is the new debt raised.

Forecast Post-Transaction Performance: Project the company's financial statements, incorporating the new, higher interest expense. Create downside scenarios (e.g., a recession) to stress-test the new capital structure.

Evaluate Credit Impact: Analyze pro forma credit metrics and ensure the company remains in compliance with its debt covenants, even under stress. Conclude with a recommendation on the maximum supportable dividend.

Key Takeaway: The dividend recap is not about growth; it's about liquidity and risk management for the equity sponsor. Your analysis must focus on creditworthiness and downside protection, proving the company can handle the increased debt burden long after the dividend is paid.

Common Pitfalls and Best Practices

Ignoring Market Conditions: A dividend recap is only feasible when debt markets are strong and lenders are willing to provide capital at reasonable rates. Acknowledge the current credit environment in your analysis.

Forgetting Covenants: Failing to model and check debt covenant compliance (e.g., leverage ratios, interest coverage ratios) is a critical error. A breach could trigger default.

Dividend recap analysis is a staple of leveraged finance groups. Mastering this case study demonstrates a sophisticated understanding of how financial sponsors use leverage to generate returns.

6. Asset-Based Lending (ABL) & Structured Finance

Asset-Based Lending (ABL) is a specialized financing solution where companies secure loans by collateralizing specific assets like accounts receivable, inventory, and equipment. This type of analysis is crucial in investment banking case studies involving companies with significant tangible assets but potentially weak or cyclical cash flows. Bankers structure these facilities by determining a "borrowing base," which dictates the maximum loan amount based on the appraised value of the collateral.

This area is vital for investment banks advising companies in distressed situations, cyclical industries like retail, or those needing flexible working capital to fund growth. Unlike traditional cash flow loans, ABL focuses on the liquidation value of assets, providing a lifeline when other financing options are unavailable. Notable real-world examples include the ABL facilities used by Bed Bath & Beyond and Toys 'R' Us during their respective restructurings.

The Interview Prompt & Solution Walkthrough

An ABL case study might ask you to structure a revolving credit facility for a struggling retailer to fund its seasonal inventory buildup. The goal is to determine a viable loan structure that provides necessary liquidity to the company while protecting the lender.

Your step-by-step approach should be rigorous:

Analyze the Collateral: Scrutinize the quality of the company's accounts receivable (A/R) and inventory. Assess A/R aging and customer concentration. For inventory, evaluate its type (e.g., finished goods vs. raw materials) and marketability.

Determine the Borrowing Base: Apply advance rates (or "haircuts") to the asset values. For example, lend 85% against eligible A/R and 50% against finished goods inventory. This calculation forms the core of the ABL model.

Model Cash Flows and Covenants: Project the company's working capital needs and cash flows to ensure the facility size is adequate. Structure covenants like a Fixed Charge Coverage Ratio (FCCR) that "springs" into effect if availability on the revolver falls below a certain threshold.

Stress Test the Structure: Model downside scenarios to test the resilience of the borrowing base. What happens if inventory values decline by 20% or a major customer defaults on its receivables?

Recommend a Final Structure: Present a term sheet outlining the facility size, pricing (interest rate), fees, covenants, and reporting requirements.

Key Takeaway: The essence of an ABL case is risk mitigation. Your recommendation must balance the client's need for capital with the lender's need for security, demonstrating a deep understanding of collateral quality and downside protection.

Common Pitfalls and Best Practices

Overly Generous Advance Rates: Using aggressive advance rates without justifying them based on asset quality is a major red flag. Always be conservative and ground your assumptions in industry norms.

Ignoring Asset Ineligibility: Failing to exclude ineligible assets (e.g., aged receivables, obsolete inventory) from the borrowing base will overstate lending capacity and show a lack of attention to detail.

ABL cases test your ability to think like a lender. A strong answer shows you can protect the bank's capital by focusing on what can be recovered in a worst-case scenario. To master this, practice building borrowing base models and understanding how credit agreements are structured.

7. Distressed M&A & Bankruptcy Analysis

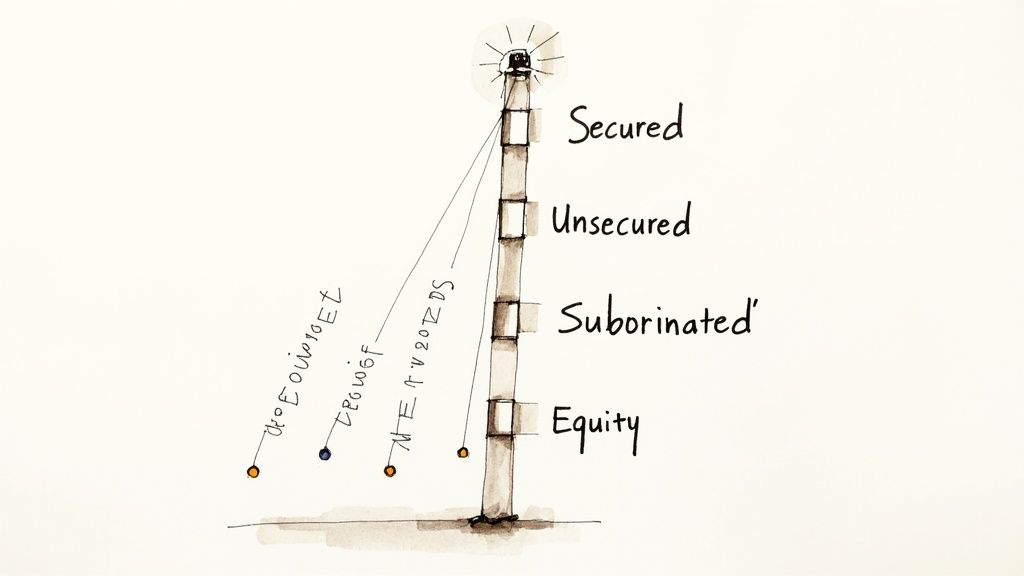

Distressed M&A analysis is a specialized area within investment banking case studies, focusing on companies facing severe financial hardship or bankruptcy. Unlike traditional M&A, this process involves navigating complex legal frameworks, creditor hierarchies, and distressed valuation techniques to advise on acquisitions, restructurings, or liquidations. The core objective is to determine a company's value under duress and structure a transaction that maximizes recovery for stakeholders.

This type of case study tests a candidate's ability to think critically about value when traditional metrics may be irrelevant. The analysis requires a deep understanding of capital structures and how value "breaks" or gets distributed among different creditor classes in a bankruptcy proceeding, often leaving equity holders with nothing.

The Interview Prompt & Solution Walkthrough

An interviewer might present a scenario where a manufacturing company has filed for Chapter 11 bankruptcy and your client, a private equity firm, is considering acquiring its assets. You would be tasked with valuing the company, assessing the viability of the assets, and recommending a bid strategy.

Your step-by-step approach should demonstrate both financial and legal acumen:

Analyze the Capital Structure: Identify all debt tranches (e.g., secured debt, unsecured bonds) and their priority in the creditor waterfall. This determines who gets paid first.

Perform a Liquidation Analysis: This is a key valuation method in distressed scenarios. Estimate the recovery value of the company's assets if they were sold off piecemeal. This sets the "floor" value for any transaction.

Conduct a Distressed DCF: Project cash flows assuming a successful operational turnaround. Use a higher WACC to account for the significant risk involved.

Evaluate Restructuring Scenarios: Assess different paths, such as a Section 363 asset sale (where a "stalking horse" bidder sets a minimum offer) or a debt-for-equity swap where creditors become the new owners.

Formulate a Bid Strategy: Recommend a bid price and structure. Explain how your bid provides a better recovery for creditors than a straight liquidation, making it more likely to be approved by the bankruptcy court.

Key Takeaway: In distressed M&A, the focus shifts from shareholder value to creditor recovery. A successful analysis justifies why a proposed transaction is the best possible outcome for creditors, who are the primary decision-makers in a bankruptcy.

Common Pitfalls and Best Practices

Ignoring Creditor Motivations: Each creditor class has different goals. Understanding their positions and potential for agreement is crucial for a viable deal.

Overly Optimistic Turnaround Plans: Base any operational improvement assumptions on realistic, defensible changes, not just wishful thinking. Acknowledge the high execution risk.

Distressed advisory is a hallmark of elite boutiques like Lazard, PJT Partners, and Moelis & Company. Mastering this type of case study shows you can handle complexity and think strategically under pressure, skills that are highly valued across all of investment banking.

8. Cross-Border M&A & FX Hedging Analysis

Cross-border M&A adds significant complexity to standard investment banking case studies by introducing foreign exchange (FX) risk, differing regulatory regimes, and complex tax implications. This type of analysis focuses on advising a company in one country on acquiring a target in another, requiring bankers to manage currency fluctuations and navigate international legal frameworks to maximize deal value and ensure a successful close.

The core challenge is that the value of the target and the cost of the acquisition can change daily due to currency movements. A deal that is attractive today might become economically unviable tomorrow if exchange rates shift unfavorably. Bankers must therefore structure deals that not only create strategic value but also protect clients from this inherent volatility.

The Interview Prompt & Solution Walkthrough

An interviewer might ask you to advise a US-based client on acquiring a UK-based target company whose financials are in British Pounds (GBP). You would need to assess the deal's financial attractiveness while accounting for the USD/GBP exchange rate risk between deal announcement and closing.

Your step-by-step approach should incorporate these additional layers:

Dual-Currency Valuation: Build the valuation models (DCF, Comps, etc.) in the target's local currency (GBP). Then, convert the final valuation into the acquirer’s currency (USD) using the current spot exchange rate and forward rates to establish a baseline.

Assess FX Exposure: Quantify the financial risk. For example, a 5% depreciation of the USD against the GBP could increase the acquisition cost by millions, eroding potential returns.

Propose Hedging Strategies: Recommend specific financial instruments to mitigate FX risk. This could include forward contracts to lock in a future exchange rate, or options that provide the right, but not the obligation, to exchange currency at a predetermined rate.

Analyze Regulatory Hurdles: Identify key regulatory bodies in both countries whose approval is required, such as the Committee on Foreign Investment in the United States (CFIUS) or the UK's Competition and Markets Authority (CMA).

Structure for Tax Efficiency: Consider how to structure the transaction to minimize the combined tax burden, taking into account different corporate tax rates and withholding tax rules between the two jurisdictions.

Key Takeaway: A strong answer goes beyond a simple currency conversion. It demonstrates a sophisticated understanding of risk management by proposing specific, justifiable hedging strategies and outlining a clear path through complex international regulatory and tax landscapes.

Common Pitfalls and Best Practices

Ignoring Transaction Timing: Failing to account for the time lag between announcement and closing, when the currency risk is highest, is a major oversight.

Simplistic Hedging: Don't just say "hedge the risk." Suggest specific instruments (e.g., a six-month forward contract) and explain why that choice is appropriate for the deal's expected timeline and the client's risk appetite.

8-Case Investment Banking Comparison

Deal Type | 🔄 Implementation Complexity | ⚡ Resource Requirements | 📊 Expected Outcomes | 💡 Ideal Use Cases | ⭐ Key Advantages |

|---|---|---|---|---|---|

Mergers & Acquisitions (M&A) Valuation Analysis | High 🔄 — complex DCF, synergies, deal structuring | High ⚡ — deep industry data, multi-method models, legal/advisory input | Clear fair-value range, accretion/dilution, synergy estimates 📊 | Strategic buy/sell decisions, large corporate combinations 💡 | Robust cross-method valuation framework; strong strategic insights ⭐ |

Leveraged Buyout (LBO) Analysis | High 🔄 — layered debt modeling and covenants | High ⚡ — detailed cash-flow forecasts, debt market knowledge | Return metrics (IRR, MOIC), leverage schedules, exit scenarios 📊 | Private equity acquisitions, recapitalizations 💡 | Teaches leverage optimization and return engineering ⭐ |

Initial Public Offering (IPO) Valuation & Pricing | Medium-High 🔄 — market-driven pricing and roadshow prep | Medium ⚡ — comparable universe, investor outreach, market timing | Pricing range, demand assessment, first-day performance prediction 📊 | Companies seeking public capital, growth-stage exits 💡 | Market-based valuation and investor sentiment calibration ⭐ |

Corporate Finance & Capital Raising | Medium 🔄 — WACC, debt/equity structuring | Medium ⚡ — credit market access, rating considerations, modeling | Optimized capital structure, cost of capital reduction, funding plan 📊 | Debt/equity raises, refinancing, liquidity planning 💡 | Practical capital-structure solutions across industries ⭐ |

Dividend Recapitalization & Special Dividends | Medium 🔄 — leverage impact and covenant analysis | Medium ⚡ — debt facilities, sponsor coordination, stress-tests | Short-term cash distribution, increased leverage metrics 📊 | Private equity value extraction, sponsor liquidity events 💡 | Enables shareholder payouts while preserving ownership value ⭐ |

Asset-Based Lending (ABL) & Structured Finance | Medium 🔄 — collateral valuation and borrowing base design | Medium ⚡ — asset audits, monitoring systems, covenant enforcement | Working-capital financing with asset-backed limits, lender protections 📊 | Distressed firms, seasonal working-capital needs, growth financing 💡 | Provides financing when traditional debt unavailable; lender protection ⭐ |

Distressed M&A & Bankruptcy Analysis | High 🔄 — legal, creditor waterfall, liquidation scenarios | High ⚡ — legal counsel, restructuring advisors, conservative models | Recovery estimates by creditor class, restructuring plan outcomes 📊 | Distressed sales, restructurings, turnaround investments 💡 | Deep recovery analysis and restructuring strategy expertise ⭐ |

Cross-Border M&A & FX Hedging Analysis | High 🔄 — multi-jurisdiction tax/regulatory structuring | High ⚡ — tax advisors, FX hedging instruments, regulatory counsel | Post-tax returns, FX exposure mitigation, regulatory clearance timelines 📊 | International acquisitions, tax-efficient structuring, FX-sensitive deals 💡 | Integrates tax, FX and regulatory planning for cross-border value preservation ⭐ |

From Case Study Drills to Superday Success

Navigating the complexities of M&A valuation, LBO modeling, and distressed M&A scenarios is the central challenge of the investment banking interview process. As we've explored through this detailed collection of investment banking case studies, success is not about memorizing formulas. It's about developing a structured, repeatable analytical framework that you can deploy under pressure, regardless of the specific prompt an interviewer presents.

Each case type, from a classic IPO valuation to a nuanced dividend recapitalization, is designed to test a different facet of your financial acumen. By deconstructing these examples, you have begun to move beyond theoretical knowledge and into the realm of practical application. The goal is to internalize the core mechanics, understand the critical assumptions that drive the outputs, and anticipate the common pitfalls that trip up less-prepared candidates.

Synthesizing Your Toolkit: Key Takeaways

The true power of practicing these investment banking case studies lies in building a versatile problem-solving toolkit. Instead of viewing each case as a separate silo, recognize the interconnected patterns and principles.

Structure is Non-Negotiable: Your first step should always be to structure the problem. Whether it's an M&A, LBO, or capital raising scenario, start by outlining your approach, stating your key assumptions, and clarifying the objective. This demonstrates a methodical mind, a highly valued trait in banking.

Assumptions Drive the Narrative: Remember that the final number is often less important than the logic behind it. Be prepared to defend every assumption, from the weighted average cost of capital (WACC) in a DCF to the entry and exit multiples in an LBO. Your ability to articulate why you chose a specific growth rate or leverage level is what separates a good answer from a great one.

Commercial Acumen is the Differentiator: The best candidates connect the technical analysis back to real-world business strategy. Why is this company a good LBO target? What are the key synergies in this M&A deal that justify the premium? What are the primary risks to the IPO valuation? Weaving this commercial insight into your technical walkthrough demonstrates you think like a banker, not just a student.

Strategic Insight: Your interview performance is a direct proxy for how you'll perform on the desk. Interviewers use these case studies to simulate the pressure and analytical rigor of the job. By mastering them, you are not just preparing for an interview; you are rehearsing for your first year as an analyst or associate.

Your Actionable Path Forward

Knowledge without action is useless. To truly cement these concepts and build the muscle memory required for Superday success, you must transition from passive reading to active, high-volume practice. Here is your roadmap:

Rebuild Models from Scratch: Don't just read the solutions. Take a blank spreadsheet and build the M&A model, the LBO model, and the DCF valuation for each case we discussed. This process will expose your blind spots and force you to understand every calculation.

Practice Under Pressure: Set a timer for 30 or 45 minutes and work through a case study prompt. This simulates the time constraints of a real interview and trains you to prioritize the most critical analyses.

Vocalize Your Thought Process: The most critical and often-overlooked step is to talk through your logic out loud, as you would in an interview. Explain your steps, justify your assumptions, and summarize your conclusions clearly and concisely. This builds the communication skills that are just as important as your technical abilities.

Ultimately, your journey through these investment banking case studies is about building confidence through competence. Each case you master is another tool in your arsenal, another scenario you are prepared to tackle. By embracing this rigorous preparation, you transform the case study from a dreaded hurdle into an opportunity to showcase your analytical talent, strategic thinking, and readiness to contribute from day one.

Ready to accelerate your learning curve and move from theory to mastery? AskStanley AI provides an AI-powered mock interview platform that generates unlimited, realistic investment banking case studies and technical questions tailored to your weaknesses. Get instant feedback and perform the high-volume, targeted practice needed to walk into your interviews with unshakable confidence by visiting AskStanley AI.