Investment Banking Interview Prep Guide

Cracking an investment banking interview comes down to a structured, repeatable plan. The goal isn't just to memorize answers; it's to build a deep, intuitive understanding of the technicals, practice applying them until it's muscle memory, and polish your story until you can deliver it flawlessly under pressure. A smart plan is your best defense against last-minute cramming and the key to building real confidence.

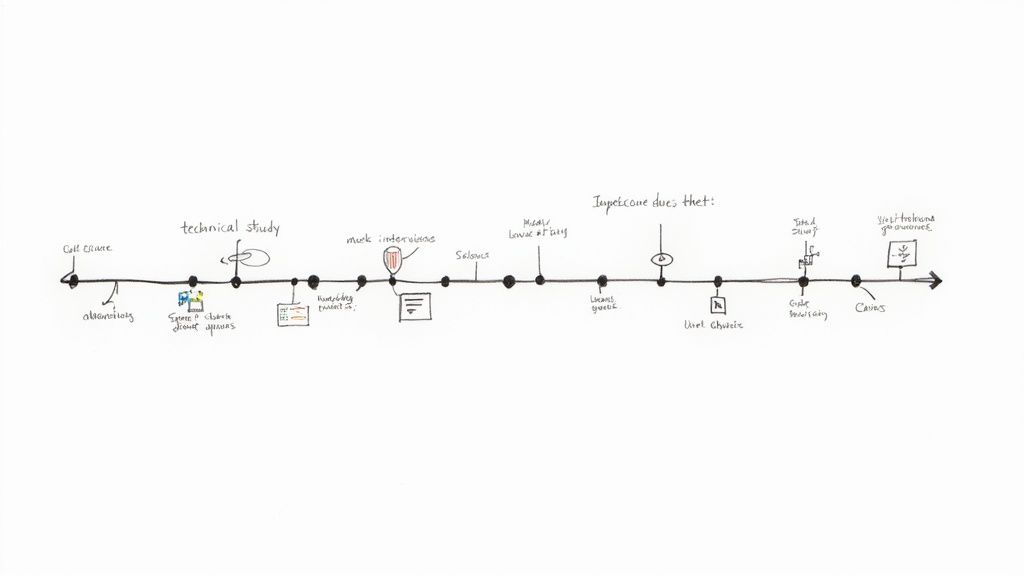

Your Strategic 6-Week Roadmap

Welcome to your game plan for landing an IB offer. The recruiting process has become incredibly compressed, leaving no room for a scattered approach. This isn't just about knowing facts—it's about internalizing concepts so you can think on your feet when a Managing Director throws you a curveball. A disciplined timeline keeps you focused and prevents burnout.

This roadmap is designed to systematically build your technical skills while sharpening your behavioral and networking game, guiding you from foundational knowledge to total interview readiness.

The New Reality of Recruiting Timelines

Forget what you might have heard about long, drawn-out recruiting cycles. The modern investment banking interview process has been squeezed from months into just a few frantic weeks. This isn't just a trend; it's a reflection of hyper-competition and heavy deal flow.

Technical grilling, once saved for final rounds, now happens right out of the gate in first-round screens. Banks need to filter candidates quickly, and they do it by testing your core knowledge early and often. It's not uncommon to face 4-6 rounds packed with technicals, case studies, and even presentation simulations.

Despite the faster pace, success rates have actually dropped, falling from 15-20% to a mere 8-12%. Why? Because banks are now interviewing 8-10 candidates for every single spot. The bar has never been higher. They're prioritizing quality over speed, so while more interviews are happening, the number of offers hasn't budged. You can find more data on these recruiting changes and why firms have shifted their strategies.

A Phased Approach to Preparation

Don't try to boil the ocean. The best way to prepare is in phases, with each one building on the last. Think of it like building a house: you pour the concrete foundation long before you start painting the walls. This layered approach ensures you develop a robust understanding, not just a superficial one.

This timeline breaks down the six-week sprint into three distinct phases: Foundation, Application, and Refinement.

This structure is designed for a progressive learning curve. You’ll start with the core concepts and methodically work your way up to high-stakes, real-world interview simulations.

Your High-Level Weekly Game Plan

Here’s a bird's-eye view of how you should be spending your time. Think of this as the strategic blueprint for the next six weeks. We’ll dive into the nitty-gritty of each component later, but this table gives you the overall structure.

| Your 6-Week IB Interview Prep Timeline |

| --- | --- | --- | --- |

| Week | Technical Focus | Behavioral & Networking Focus | Practical Application | | Weeks 1-2 | Foundation Building: Master accounting, the 3 financial statements, and core valuation (DCF, Comps). | Story Crafting & Outreach: Perfect your "walk me through your resume," and start your networking outreach. | Light modeling drills and concept review. | | Weeks 3-4 | Application: Dive into LBO and M&A modeling. Deepen your understanding of valuation nuances. | Behavioral Polish & Follow-Ups: Refine your answers to fit questions. Maintain networking momentum. | Start mock interviews (peer-to-peer). Build full financial models from scratch. | | Weeks 5-6 | Refinement: Focus on advanced technicals and current market events. Solidify deal knowledge. | Final Touches & Relationship Management: Conduct high-pressure mocks. Send final networking updates. | Intensive mock interviews with industry professionals. Live deal discussions. |

This table maps out your journey from theory to interview-ready execution. Follow it, and you'll cover all your bases without getting overwhelmed.

The goal isn't just to know the answer, but to own the answer. Anyone can recite a definition; the top candidates can explain the 'why' behind it, connect it to a recent market event, and discuss its practical implications. This is the level of mastery you are aiming for.

Navigating the Technical Gauntlet

Technical questions are the gatekeepers of any investment banking interview. There’s no talking your way around them. Surface-level knowledge just won't cut it. What separates the candidate who gets the offer from everyone else is true fluency—the ability to break down complex topics with the simple clarity of a seasoned analyst.

This isn’t about reciting definitions from a prep guide. It’s about showing you have an intuitive command of the concepts. Anyone can list the three financial statements. Top-tier candidates can walk you through exactly how a $10 increase in depreciation flows through all three, explaining every impact on taxes, cash flow, and retained earnings without missing a beat.

Your goal is to shift from memorization to storytelling. You need to guide the interviewer through your thought process, connecting abstract financial concepts to real-world business decisions.

Mastering the Core Concepts

Your entire technical foundation rests on a few key pillars. Before you even dream of tackling advanced M&A or LBO questions, you need an unshakable grip on the fundamentals of accounting and valuation. Don't skim this part; it's where most interviews are truly won or lost.

Your first move is to lock down these areas:

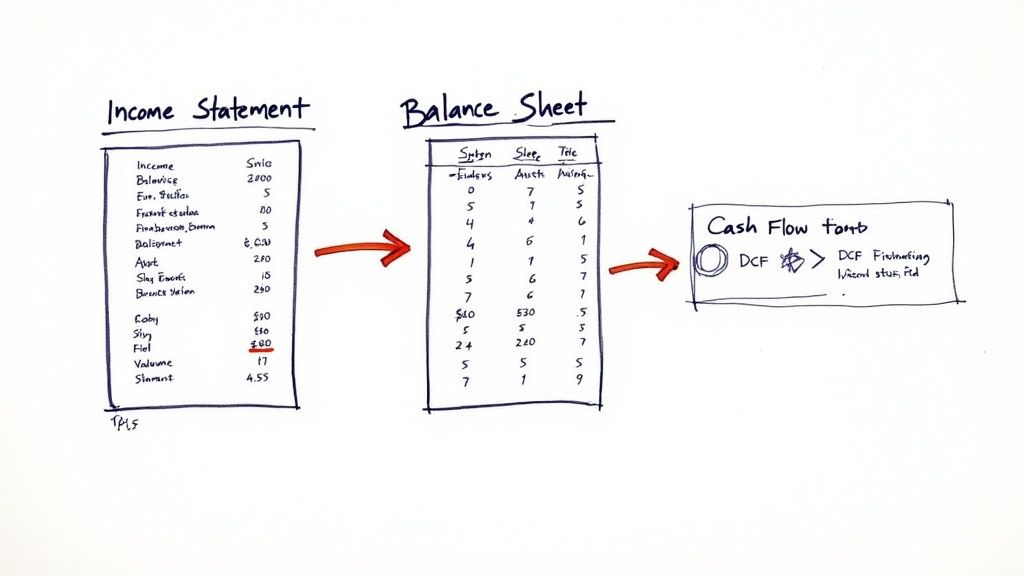

Accounting: You have to know the relationship between the Income Statement, Balance Sheet, and Cash Flow Statement like the back of your hand. Be ready for questions that test these links, like how a change in working capital, an asset sale, or new debt ripples through the statements.

Valuation: Know the "big three" methods inside and out—Comparable Company Analysis (CCA), Precedent Transaction Analysis, and Discounted Cash Flow (DCF) Analysis. For each one, you can't just explain how it works, but why you'd choose one over the other in a given situation.

Enterprise Value vs. Equity Value: Get the conceptual difference down cold and be able to calculate each. You must know how to build a bridge from one to the other, explaining precisely why you add or subtract items like cash, debt, and minority interest.

An interviewer doesn't just want to know if you can calculate Enterprise Value. They want to know if you understand that it represents the value of a company’s core business operations to all capital providers—both debt and equity holders. It's this conceptual clarity that really matters.

This foundational knowledge is the bedrock for every other technical question that comes your way. Rushing it is a surefire way to get tripped up when the questions inevitably get harder.

From Theory to Application

Once the fundamentals are solid, it's time to apply them to more complex scenarios involving M&A and LBOs. This is where your storytelling ability really comes into play. You won't just be asked for a formula; you'll be asked to walk through a model or a deal.

A classic question is, "Walk me through a DCF." A weak answer just lists the steps mechanically. A strong answer tells a story: "We start by projecting a company's unlevered free cash flows, which really just represents the cash generated by the core business before thinking about its capital structure..." This narrative approach proves you grasp the underlying logic.

To get ready for these tougher topics, always focus on the "why" behind each step.

For LBOs: Why do you analyze credit stats like Debt/EBITDA? (To make sure the company can actually handle its new debt load). How do the different levers—purchase price, leverage, EBITDA growth—drive returns for the sponsor?

For M&A: How do you figure out if a deal will be accretive or dilutive? (By comparing the acquirer's standalone EPS to the pro-forma EPS of the combined company). What are the real drivers of synergies?

Getting this level of detail requires practice. You can learn more about how to structure your answers by checking out our guide on the four types of technicals you will get asked in your investment banking interview, which breaks these categories down even further.

Sample Questions and Answer Frameworks

To give you a model for your own responses, here are a couple of realistic questions and a framework for a compelling answer. The goal is always to be structured, concise, and confident.

Question: "When would you use an LBO model for valuation, and why might it give you a lower value than a DCF?"

How to Structure Your Answer:

Define the Use Case: Start by explaining that an LBO is used to figure out what a financial sponsor, like a private equity firm, could realistically pay for a company while still hitting its target IRR (usually 20-25%).

Explain the "Why": Frame it as a "floor" valuation. It’s based on pure financial returns, not the strategic synergies a corporate buyer might be willing to pay a premium for.

Contrast with DCF: Point out that a DCF often results in a higher valuation because the discount rate (WACC) is typically lower than a PE firm's high IRR hurdle, and the projections themselves might be more optimistic.

Question: "What's the difference between Precedent Transactions and Comparable Companies?"

How to Structure Your Answer:

Core Difference: Lead with the main distinction—precedents are based on what companies were actually acquired for, while comps are based on where similar companies are currently trading today in the public market.

Valuation Impact: Explain that precedent transactions almost always yield a higher valuation multiple because they include a "control premium"—the extra amount an acquirer pays to gain control of a business.

When to Use Each: Briefly touch on context. Comps are great for a current snapshot of the market, while precedents are most relevant in an M&A context.

Practicing your answers out loud is non-negotiable. It helps you find a natural rhythm, expose any gaps in your logic, and build the confidence you need to get through the technical gauntlet.

Crafting Your Personal Narrative for Fit Questions

While technical chops prove you can build the models, your personal story proves you can actually do the job. The “fit” interview is where banks decide if you're the person they want to see in the office during those 100-hour weeks. This isn't just a personality quiz; it’s a test of your motivation, your grit, and whether you genuinely belong on their team.

Acing this part of your investment banking interview prep demands more than just being polite. You need a rock-solid narrative that connects your past experiences directly to the unique demands of a banking career. A great story makes you memorable and convinces the interviewer you’re not just another applicant, but a future colleague.

Deconstructing the "Why Investment Banking" Story

This is it—the single most important fit question you will get. If your answer sounds anything like "I love finance" or "I want to work with smart people," you might as well pack your bags. That's a direct flight to the rejection pile.

Your story needs to be authentic, personal, and make perfect logical sense. A winning narrative always connects three dots:

The Spark: What first put finance on your radar? It could have been a specific class project, a conversation about a family business, or an article that genuinely caught your interest.

The Exploration: How did you follow up on that spark? This is where you bring in your internships, finance club leadership, or the valuation courses you took on your own time. Show them you didn't just think about it; you did something about it.

The Decision: Why is investment banking the only logical next step for you, and why this firm in particular? This final point should feel like the inevitable conclusion to the story you've just told.

Your narrative should paint a clear picture of someone moving from initial curiosity to deep conviction. It shows you've made a deliberate, well-researched choice, not just followed the herd.

Structuring Your Stories with the STAR Method

For pretty much every other behavioral question—from "Tell me about a time you worked on a team" to "Describe a failure"—the STAR method is your best friend. It’s a simple but powerful framework that keeps you from rambling and ensures you deliver a complete, impactful answer.

The STAR method breaks your story down into four clean parts:

S - Situation: Briefly set the stage. What was the context? (e.g., "In my summer internship, my team was tasked with analyzing a potential acquisition for a client.")

T - Task: What was your specific job? (e.g., "My role was to build the initial valuation model for the target company.")

A - Action: What specific steps did you personally take? This is where you shine. Focus on your contributions. (e.g., "I pulled data from public filings, built out a three-statement projection, and ran a DCF analysis to establish a valuation range.")

R - Result: What was the outcome? Use numbers whenever you can. (e.g., "My analysis was included in the final pitch deck, and the client used our valuation as a key reference point in their go-forward strategy.")

Using this structure guarantees your answers are concise, relevant, and showcase the exact skills bankers want to see: analytical horsepower, teamwork, and initiative.

Your resume lists what you've done; your stories bring those accomplishments to life. The STAR method is the tool that turns a simple bullet point into a compelling narrative of your value.

Mastering the Most Common Fit Questions

Beyond the big "why" question, you need to have polished answers ready for a few other classics. Nailing these will not only boost your confidence but also let you control the interview's flow.

"Walk Me Through Your Resume" This is not an invitation to read your resume out loud. It's a prompt to tell your professional story in 90-120 seconds. Start with your background (university, major) and move chronologically through your key experiences. For each role, highlight one or two key takeaways that are directly relevant to banking. Your last sentence should tie it all together and explain why you're sitting in that interview today.

"What Are Your Greatest Strengths and Weaknesses?" For strengths, pick two or three that an analyst absolutely needs—like attention to detail, a strong work ethic, or coachability—and have a quick STAR-method example ready for each one.

For weaknesses, the goal is to show self-awareness and a proactive mindset.

Avoid clichés: "I'm a perfectionist" or "I work too hard" are tired, transparent, and unoriginal.

Choose a real weakness: Pick a genuine area for development. Maybe it's public speaking or getting bogged down in minor details at the start of a project.

Show you're working on it: Explain the concrete steps you're taking to improve. For example, "I sometimes get too deep in the weeds early on, so now I've disciplined myself to build a high-level project outline first. This ensures I'm always aligned with the big picture before I dive into the granular details."

This approach turns a potential negative into a positive, demonstrating maturity and a growth mindset. At the end of the day, every fit question is another chance to reinforce your personal brand and prove you have what it takes to hit the ground running.

Applying Your Knowledge with Financial Modeling

Knowing the theory gets you in the room; building a clean model gets you the offer.

It’s one thing to define a Discounted Cash Flow (DCF) model. It’s another thing entirely to build one from scratch, under pressure, with an MD watching over your shoulder. Modeling tests and on-the-spot case studies are now standard practice, and they’re designed to weed out the candidates who’ve only read about banking from those who can actually do the work.

This is your chance to prove you have the technical chops, attention to detail, and logical thinking the job demands. A well-built model is more than just a spreadsheet—it's proof you can translate complex financial concepts into a real decision-making tool.

Building from the Ground Up

You can’t run before you can walk. The fastest way to get overwhelmed is by jumping straight into a complex leveraged buyout (LBO) model without having a rock-solid grasp of basic accounting. It’s a recipe for disaster.

Instead, build your skills progressively. Start simple and layer on complexity.

Three-Statement Model: This is the absolute bedrock. Before you do anything else, you need to be able to build a dynamic model linking the income statement, balance sheet, and cash flow statement. The goal is to master the core connections, like how Net Income flows into Retained Earnings and links back to the Cash Flow Statement. If those connections feel fuzzy, take a step back and walk through the 3 financial statements explained simply before you start building.

Discounted Cash Flow (DCF) Model: Once your three-statement model is flawless, build a full DCF on top of it. This means projecting out unlevered free cash flows, calculating a terminal value, and determining the right discount rate (WACC) to land on an enterprise value.

LBO and M&A Models: These are the big leagues for interview prep. An LBO model will test your understanding of debt schedules and returns analysis (like IRR), while an M&A model is all about accretion/dilution and pro-forma balance sheet math.

Don't just build these models once. Build them over and over until the process is muscle memory.

Best Practices That Interviewers Look For

Your model’s final number is important, but how you get there is just as critical. Bankers live in Excel, and they value clarity and efficiency above all else. A messy, hard-to-follow spreadsheet is a massive red flag.

As you practice, ingrain these habits:

Color Coding: Be consistent. The industry standard is pretty simple: blue for hard-coded inputs, black for formulas pulling from the same sheet, and green for formulas linking to other sheets.

Keyboard Shortcuts: Ditch the mouse. Speed is everything. Mastering shortcuts like Alt + E, S, V (Paste Special) and Ctrl + [ (trace precedents) will instantly make you look like you belong.

Error Checking: Always, always build checks into your model. The most obvious one? Your balance sheet must balance. If Assets don't equal Liabilities + Equity, you’ve got a problem. Find it.

A good model should speak for itself. If a colleague can open your spreadsheet and understand your logic without a 20-minute explanation, you’ve done your job well. Simplicity and organization are everything.

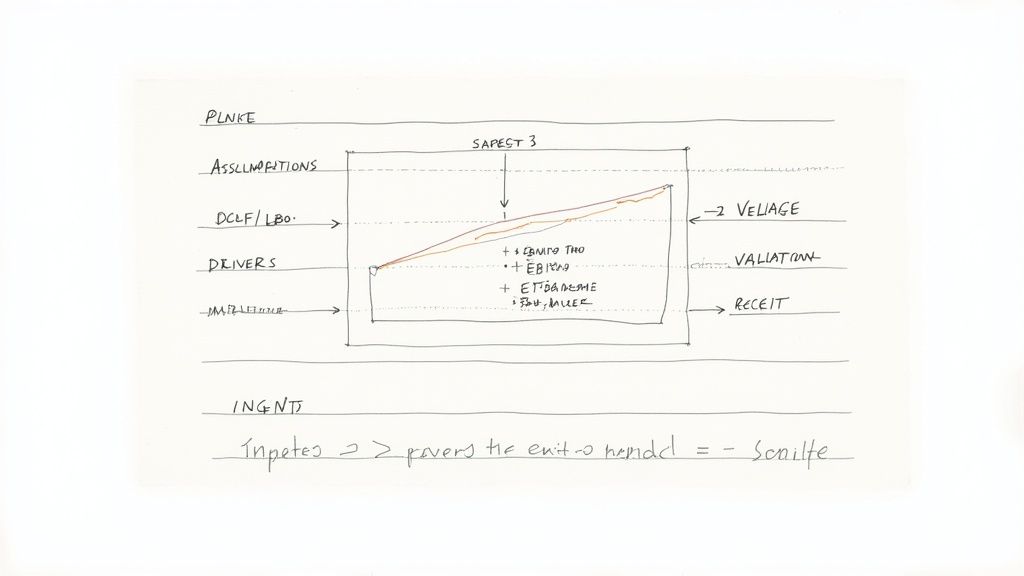

Articulating Your Assumptions and Drivers

Building the model is only half the battle. You have to be able to talk about it.

An interviewer is guaranteed to poke holes in your work, testing your commercial awareness and how well you actually understand the business you’re modeling.

Get ready to defend your key assumptions:

Revenue Growth: Why 5% and not 10%? Is that based on historical trends, management guidance, or your own industry research?

Margins: What’s driving the company's EBITDA margins? Are they fixed or scalable? What happens if a key input cost doubles?

Terminal Value: Why did you pick the Exit Multiple Method over the Gordon Growth Method? What are the pros and cons of that choice for this specific company?

These aren't "gotcha" questions. They’re designed to see if you’re just a number-cruncher or a strategic thinker who can connect the model to what’s happening in the real world. That ability to discuss your work intelligently is what truly separates a good candidate from a great one.

Pressure-Testing Your Skills with Mock Interviews

You can build flawless models alone in your room and nail every technical question in a prep guide, but that’s only half the battle. Isolated practice creates dangerous blind spots. None of it matters if you can't perform under the intense pressure of a real interview.

Mock interviews are where your prep meets reality. This is the only way to simulate the stress, pace, and unpredictable nature of a Superday. It’s where you learn to think on your feet when a follow-up question throws you off balance or you need to articulate a complex M&A concept with total clarity. The goal isn't just to practice—it's to pressure-test your entire skillset.

Finding Quality Mock Interview Partners

The value of a mock interview is only as good as the person sitting across from you. Your partner needs to be sharp enough to ask tough questions and provide honest, critical feedback. A generic practice session with a well-meaning friend just won't cut it.

You have to find people who understand the specific demands of investment banking recruiting. Here are your best bets:

University Career Centers: Most schools with solid finance programs offer mock interview services with counselors trained in the specifics of IB interviews. This should be your first and most accessible option.

Alumni Networks: Get in touch with second-year analysts or associates who just went through the process. They have the freshest perspective on what interviewers are looking for and can give you incredibly relevant feedback.

Industry Professionals: A cold email to an analyst at a firm you admire can sometimes land you a quick 30-minute mock. Just frame it as asking for a small chunk of their time to get a real-world gut check on your readiness.

Remember, the point of a mock interview isn't to get an ego boost—it's to find your flaws. Actively seek out partners who you know will be tough on you. A session that leaves you feeling a bit beaten down is far more valuable than one that just confirms what you already know.

How to Structure and Record Your Mocks

Don’t just wing it. To get the most out of each session, you need structure. Treat it exactly like a real interview: dress the part, have your resume handy, and come prepared with a few sharp questions for your "interviewer."

Even more important, you have to record your performance. Use your phone or webcam to film the session. Watching yourself back is usually painful, but it's always revealing. You’ll immediately notice verbal tics like saying "um," fidgeting, or failing to make eye contact when explaining a technical concept.

This process of recording and reviewing is a core part of deliberate practice. For more strategies on how to structure these sessions and other practice methods, our complete interview skills practice guide offers detailed frameworks you can apply immediately.

A Rubric for Honest Self-Evaluation

After each mock, you need a system to grade yourself honestly. This is how you stop glossing over weaknesses and start tracking real progress. Use a simple scoring rubric to evaluate your performance across key areas.

Here's a rubric you can use to score your performance and pinpoint exactly where you need to improve.

Mock Interview Self-Evaluation Rubric

Category | Criteria for Success (5 points) | Needs Improvement (1-2 points) | Your Score |

|---|---|---|---|

Technical Fluency | Answered technicals instantly and correctly; explained the "why" behind concepts. | Fumbled on definitions; could not apply concepts to new scenarios. | |

Behavioral Narrative | Stories were structured (STAR), compelling, and directly relevant to banking skills. | Answers were rambling, lacked specific results, or felt generic. | |

Resume Walkthrough | Delivered a concise story under 2 minutes, hitting key highlights. | Read resume bullet points or exceeded the 2-minute mark significantly. | |

Clarity & Confidence | Spoke clearly, maintained eye contact, and showed poise under pressure. | Used filler words, appeared nervous, or struggled to articulate thoughts. | |

Overall Impression | Came across as prepared, motivated, and a strong cultural fit. | Seemed unprepared, lacked genuine interest, or gave robotic answers. |

This simple tool forces you to confront your weak spots head-on. If you consistently score low on technical fluency, you know exactly where to focus your study time for the next week. This data-driven approach turns abstract practice into a measurable plan for improvement.

Common Questions About IB Interview Prep

Even with the best-laid plans, you’re going to hit some roadblocks during your investment banking prep. Everyone does.

Getting good answers to these common hurdles can be the difference between spinning your wheels and making real progress. Let's tackle the questions that come up most often.

How Much Time Should I Dedicate to Prep Each Day?

Forget cramming for ten hours straight—that’s a recipe for burnout. The real key is building a sustainable, disciplined routine that lets the information actually stick. Consistency will always beat last-minute intensity.

A good rule of thumb is aiming for 2-3 hours of focused work on weekdays and a more substantial 4-5 hours on the weekend. If you can keep that pace for six to eight weeks, you'll build the deep knowledge base you need.

Here’s one way to break that down during the week:

1 Hour of Technicals: This is your time for guide-reading, concept reviews, and flashcard drills to keep the fundamentals sharp.

1 Hour of Application: Use this block for practical stuff—reading up on the market, analyzing a recent deal, or running quick modeling exercises.

Weekends are for the deep dives. Block out time to build a full financial model from scratch or, even more importantly, run a full-length mock interview. This rhythm makes sure you’re hitting both theory and practice, week in and week out.

What Is the Biggest Mistake Candidates Make in Technical Interviews?

Hands down, the single biggest mistake is rote memorization. Interviewers are trained to sniff this out in seconds. They won't just ask you to define WACC; they’ll throw a curveball like, "How does a change in the corporate tax rate affect WACC, and why?"

If you've only memorized the formula, you're toast.

The fix? Constantly ask yourself why. Why is debt cheaper than equity? Why do we unlever and then relever beta in a DCF? When you understand the logic behind the formulas, you can handle anything they throw at you.

True mastery means you can explain the logic behind the formula, not just recite the formula itself. This conceptual fluency is what separates top candidates from the rest of the pack. Focus on the "why" behind every technical point, not just the "what."

How Do I Answer "Why This Firm?"

A generic, cookie-cutter answer is an instant red flag. You have to prove you’ve done real homework that goes way beyond a quick skim of their homepage.

Start by finding a few recent M&A deals they’ve advised on, preferably in an industry you’re actually interested in. Be ready to talk through one of them in detail—the strategic rationale, the valuation, your take on the transaction.

Then, dig into the specific group you’re interviewing with. Who are the senior bankers? What’s their reputation in the market? Mentioning specific deals, people, or even unique cultural tidbits you found—like a specific mentorship program—shows you’re serious.

Is It Okay to Say "I Don't Know?"

Yes. It's far, far better than trying to bluff your way through an answer and getting exposed. Bankers value intellectual honesty.

But how you say it makes all the difference. Don't just shut down.

A much stronger approach is to say something like, "That's a great question. While I'm not 100% certain, my first instinct would be to think about it like this..."

Then, walk them through your thought process out loud. Try to reason through a logical answer, even if it’s not perfect. This turns a moment of weakness into a chance to show them how you think under pressure—a skill they’re definitely looking for.

Ready to stop guessing and start mastering your interview prep? AskStanley AI provides unlimited, realistic mock interviews and technical drills that adapt to your performance. Get the data-driven feedback you need to walk into your interviews with total confidence. Start your training today.

Article created using Outrank