A Practical Guide to the Sources and Uses Table

A sources and uses table is one of the first things you'll build when looking at any deal. In simple terms, it's a quick summary showing where all the money is coming from (the Sources) and exactly where it's all going (the Uses).

Before anyone signs on the dotted line for an acquisition or buyout, this table proves the deal is fully funded and every single dollar has a job.

What Is a Sources and Uses Table?

Think about it like planning a big home renovation. Before you hire a contractor, you figure out your budget. On one side, you list all the cash you have on hand: your savings, a home equity loan, and maybe some money from your parents. These are your Sources.

On the other side, you list out every single thing you need to pay for: the contractor, lumber, new appliances, city permits, and a little extra just in case something goes wrong. These are your Uses. You don't start demolition until your total sources match your total uses. If they don't balance, you've got two choices: find more money or scale back the project.

A sources and uses table in finance works on the exact same principle. The numbers are just a lot bigger. It's the go-to checklist to make sure a deal is financially buttoned up from day one.

The Golden Rule of Sources and Uses

There's one rule that you can never, ever break: Total Sources must always equal Total Uses. No exceptions.

This perfect balance is non-negotiable. It proves to everyone involved—the buyer, the seller, the banks—that the deal has been thought through and there's enough cash to get it done.

A sources and uses table isn’t just an accounting exercise; it’s the first reality check for any deal. It forces clarity and discipline by demanding that every dollar has a name and a purpose from the very beginning.

It’s the high-level snapshot of the entire transaction, summarizing the deal's capitalization in a way anyone can understand. That’s why it’s one of the first things investment bankers and private equity analysts put together when they start looking at a company.

Here's a quick look at the typical line items you'll find in a sources and uses table.

Common Sources and Uses Items at a Glance

This table breaks down the usual suspects you'll see on both sides of the ledger. While every deal is different, these are the core components.

Category | Common Examples |

|---|---|

Sources of Funds | New Debt (Term Loans, Revolvers), Buyer Equity Contribution, Seller Rollover Equity, Excess Cash from Target |

Uses of Funds | Purchase Price of Target's Equity, Refinancing Existing Debt, Transaction Fees, Financing Fees |

Understanding these buckets is the first step. Next, we'll walk through how to actually build one of these tables from scratch.

Why This Table Is a Deal's Blueprint

The sources and uses table is way more than just another schedule in a financial model; it’s the blueprint holding the entire deal together. It serves as the ultimate reality check, giving you a clean, simple summary of how a massive transaction is actually going to get funded and closed.

Think of it like an architect's plan for a skyscraper. Before you can even think about laying the foundation, you have to prove you have the materials and the money locked down for every single floor.

The table’s main job is to enforce financial discipline. It forces everyone involved to track every dollar coming in (the sources) and assign it a specific job (the uses). There's no room for fuzzy math. This simple balancing act prevents the single most dangerous problem in any deal: a funding gap.

The Single Source of Truth

In any big transaction, you've got a lot of people at the table with different priorities—buyers, sellers, lenders, and investors. The sources and uses table becomes the common language, creating one undisputed document that everyone can point to. It cuts through all the noise and lays out the deal’s financial guts in a way anyone can understand.

Getting everyone on the same page is critical for a few reasons:

For Lenders: Banks and credit funds live and die by this table. They need to see exactly how much of the buyer's own cash (equity) is on the line compared to the debt they're being asked to provide.

For Buyers: It confirms the exact check they need to write. It also shows how their funds, combined with new debt, will cover every single cost to get the deal done.

For Sellers: The table gives them confidence that the buyer actually has the cash and financing lined up to make good on the purchase price.

By creating this shared view, the table builds trust and transparency. That’s the stuff that actually gets complicated deals across the finish line.

Preventing Gaps and Ensuring Viability

The most important role of the sources and uses table is to prove a transaction is fully funded. It forces you to account for every single anticipated cost—not just the big headline purchase price, but also the advisory, legal, and financing fees that can easily run into the millions.

The core idea is simple but powerful: if you can't get the sources to equal the uses, you don't have a deal. It forces an immediate, and very necessary, conversation about either finding more capital (sources) or cutting costs (uses).

Let’s say a private equity firm is planning a $500 million leveraged buyout. Their sources might be $300 million in new debt from banks and $200 million of their own fund's equity. The "uses" side has to add up to exactly $500 million, covering the equity purchase, paying off the target's old debt, and handling all the transaction fees.

If the uses actually total $510 million, the table instantly flags a $10 million shortfall. That gap has to be solved before anyone moves an inch.

This makes the sources and uses table one of the most essential planning tools in finance. It’s the very first test of a deal’s structural integrity and the foundation every other part of the financial model is built on. If you want to work in this world, mastering it is non-negotiable.

How to Build a Sources and Uses Table from Scratch

Alright, enough with the theory. Let's get our hands dirty.

Building a sources and uses table isn't just a mechanical exercise in Excel. It’s about telling the entire story of a transaction in one simple, balanced snapshot. This walkthrough will show you exactly how to do it, step-by-step.

We're going to build a table for a classic M&A deal. Think of this as your playbook for turning a bunch of deal assumptions into a clean, logical table that proves the deal can actually be funded.

At its core, the S&U table serves as the deal's blueprint. It’s a reality check that keeps everyone honest and ensures the math works.

This process is what makes the table so powerful. It grounds the deal in financial reality, forces buyers and sellers to agree on the numbers, and prevents any nasty surprises at the closing table.

Setting Up the M&A Scenario

First things first, let's lay out the facts for our hypothetical deal. You can't build the table until you know exactly what you're buying and how you're paying for it.

Here’s the setup: "Acquirer Co." is buying "Target Co."

These are the key numbers we need to work with:

Purchase Equity Value: The price Acquirer Co. is paying for Target Co.'s stock is $500 million.

Target Co.'s Existing Debt: Target Co. has $150 million in debt on its books that has to be paid off when the deal closes.

Transaction Fees: We're estimating $20 million for the lawyers, accountants, and bankers making this deal happen.

Financing Fees: The banks arranging the new debt aren't working for free. Their fees come out to $10 million.

These numbers are the foundation for the "Uses" side of our table. They represent every single dollar we need to spend.

Populating the Uses of Funds

With our deal facts in hand, we can start filling out the "Uses" side. This is usually the easier side to start with because the costs are either known or can be estimated pretty accurately.

Let's list out all the checks we need to write:

Purchase of Target Equity: This is the main event—the $500 million needed to actually buy the company's shares.

Refinance Target's Debt: We have to pay off the target's old lenders, which will cost $150 million.

Pay Transaction Fees: These are the M&A advisory, legal, and diligence fees, which add up to $20 million.

Pay Financing Fees: These fees go to the lenders for arranging the new debt and total $10 million.

Add it all up, and our total uses of funds come to $680 million ($500M + $150M + $20M + $10M). That's our magic number. The "Sources" side has to match it to the penny.

Structuring the Sources of Funds

Now for the interesting part: where is all that money coming from? The "Sources" side maps out the entire financing plan, showing the mix of debt and equity used to fund the purchase. A solid grasp of how the three financial statements connect is super helpful here.

For this deal, Acquirer Co. is using a combination of new debt and its own cash. Here’s the breakdown:

Term Loan B: A big chunk of senior debt from institutional lenders. Let's say they're raising $300 million.

Revolving Credit Facility: A flexible line of credit, almost like a corporate credit card. While the total facility might be larger, they'll draw down $50 million at closing.

Seller Rollover: The management team at Target Co. is bullish on the future and agrees to "roll" $30 million of their equity into the new company. This is a common way to align incentives and also serves as a source of funds.

So far, that gives us $380 million in financing. We're still short of the $680 million we need.

The missing piece is called the equity contribution, or simply "the plug." It’s the cash the buyer has to come up with out of their own pocket after all other financing is in place. It's the ultimate skin in the game.

To calculate the equity contribution, we just subtract our known sources from the total uses: $680 million (Total Uses) - $380 million (Debt & Rollover) = $300 million.

So, Acquirer Co. needs to write a check for $300 million.

The Final Balanced Table

Now we have all the pieces. Let's assemble them into the final, balanced sources and uses table. This summary is what it's all about—presenting the entire deal on a single, easy-to-understand schedule.

Here is a simple model illustrating our hypothetical M&A transaction:

Example Sources and Uses for a Hypothetical M&A Deal

Line Item | Amount ($MM) |

|---|---|

Sources of Funds | |

Term Loan B | $300 |

Revolving Credit Facility | $50 |

Seller Rollover Equity | $30 |

Buyer Equity Contribution | $300 |

Total Sources | $680 |

Uses of Funds | |

Purchase of Target Equity | $500 |

Refinance Target's Debt | $150 |

Transaction Fees | $20 |

Financing Fees | $10 |

Total Uses | $680 |

And there you have it. Total Sources equals Total Uses. The table is perfectly balanced, which confirms the transaction is fully funded and ready to go. This simple but critical summary is the foundation of any deal model, giving all stakeholders a clear financial blueprint.

Adapting the Table for M&A, LBO, and Refinancing Deals

The golden rule of a sources and uses table never changes: both sides have to balance to the penny. What does change is the story it tells. Think of it as a flexible blueprint that adapts to show the unique financial strategy behind any given deal.

Getting a feel for how the line items shift between a standard M&A deal, a debt-heavy LBO, and a simple refinancing is key. Each scenario rearranges the puzzle pieces, highlighting different ways to raise capital and different places for that money to go. Once you understand these variations, you can quickly grasp what a deal is really about.

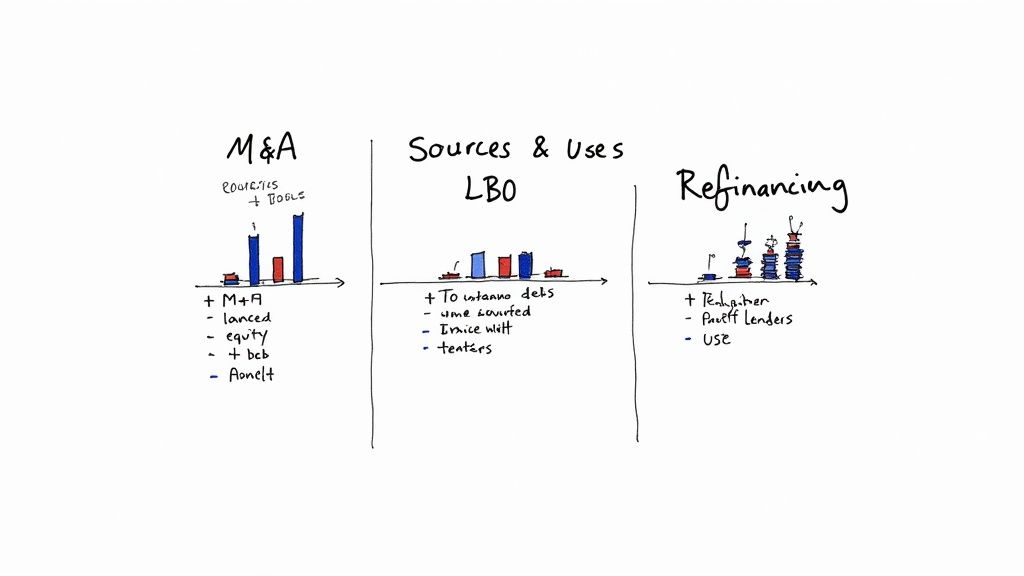

M&A Acquisition Structure

In a classic M&A deal, one company (the strategic buyer) is buying another (the target). The sources and uses table here usually shows a pretty balanced funding approach.

On the "Sources" side, you'll typically see a mix of the buyer’s own cash on hand ("Cash from Balance Sheet") and some new debt they raised just for the deal. The "Uses" side is clean and simple—it's all about paying for the company.

Primary Sources: Buyer's cash, new senior debt.

Primary Uses: Purchase of the target's equity, refinancing the target's existing debt, and paying transaction fees.

This structure tells you the buyer is financially strong and can secure traditional financing. The whole point is to absorb the target and integrate it into their own operations.

Leveraged Buyout (LBO) Structure

A Leveraged Buyout, or LBO, is a completely different animal. This is where a private equity (PE) firm buys a company using a massive amount of borrowed money—that’s the "leverage." The entire game plan is to use the target company's own cash flow to pay down all that debt over the next few years.

As you’d expect, the LBO sources and uses table looks incredibly debt-heavy. The "Sources" side will be stacked with multiple layers of different debt types, which often dwarf the actual cash put in by the PE firm.

An LBO's sources and uses table is all about leverage. The story isn't just about buying a company; it's about how much debt can be surgically layered into the capital structure to maximize returns for the financial sponsor.

The financing is way more complex and might include:

Term Loan B: Senior debt from institutional lenders.

High-Yield Bonds: Riskier, unsecured debt (think junk bonds).

Mezzanine Debt: A hybrid of debt and equity.

Sponsor Equity: The PE firm's cash contribution, which is usually a surprisingly small slice of the pie, maybe just 20-40% of the total funds.

The "Uses" side looks similar to an M&A deal, but the sheer scale of debt funding the purchase is what defines it. You'll run into these structures all the time, so it's smart to practice with a variety of investment banking case studies.

Debt Refinancing Structure

A refinancing isn't about buying anything new. It's about a company swapping out its old debt for new debt. They're usually trying to lock in a better interest rate, push out their repayment deadlines, or just clean up a messy capital structure.

Here, the sources and uses table tells a story of replacement. The main "Source" is the new debt the company is issuing. The main "Use"? Paying off the old debt. It’s that simple.

Let's break down the focus for each deal type:

Transaction Type | Key Focus on Sources Side | Key Focus on Uses Side |

|---|---|---|

Standard M&A | Mix of buyer cash and new debt | Purchase of target equity |

LBO | Multiple tranches of new debt | Purchase of equity & fees |

Refinancing | Issuance of new, cheaper debt | Repayment of old, expensive debt |

This same principle of capital shifting to its best use plays out on a global scale. For instance, global trade patterns constantly evolve. In the first half of 2025, global trade grew by roughly $500 billion, driven by manufacturing and services. Growth in goods trade picked up from 2.0% to 2.5% quarter-over-quarter, a perfect example of how capital and products flow to where they are needed most. You can read more in the UNCTAD global trade update.

If you can master these three variations, you'll be able to quickly decipher the financial narrative of almost any major corporate deal. Each table is a blueprint, and learning to read it is a foundational skill in finance.

Common Interview Questions and Mistakes to Avoid

Knowing how to build a Sources and Uses table is one thing. Explaining it cleanly under pressure during an interview? That’s a whole different game.

This is where a lot of sharp candidates trip up. Interviewers aren’t just checking a box to see if you can make two columns balance. They're testing your grasp of the deal's logic and, more importantly, your attention to detail.

Think of this as your interview playbook. Get these details right, and you'll signal that you're ready for the desk.

Typical Interview Questions

Interviewers love "walk me through" questions because they can't be memorized easily. They reveal how you think. You should be ready to answer these without skipping a beat.

Here are a few classics you're almost guaranteed to get:

"Walk me through the sources and uses for a leveraged buyout." This is the big one. They want to see if you understand how a debt-heavy deal comes together. Be ready to list specific debt tranches like Term Loan B or High-Yield Bonds as Sources.

"Where do you account for financing fees versus transaction fees?" A classic trick question. Both are Uses, but they’re not the same. Financing fees go to the lenders for providing the debt; transaction fees go to advisors like bankers and lawyers for getting the deal done.

"How does a seller rollover affect the sources and uses table?" Seller rollover is a Source of funds. It's essentially the seller "re-investing" some of their payout back into the new company, which means the buyer needs less cash to close the deal.

Critical Mistakes That Cost Offers

The real test isn't just reciting definitions; it's avoiding the small but fatal errors that scream "inexperienced." These are the most common landmines. Dodge them, and you’ll immediately stand out.

Forgetting Transaction or Financing Fees This is, without a doubt, the most frequent mistake. A candidate will nail the equity purchase price and the debt financing but completely forget to add a line item for banking, legal, and financing fees on the Uses side. It instantly unbalances the table and shows you haven't thought through the practical costs of a deal.

Mishandling the Target's Cash This is a more subtle point that separates the good candidates from the great ones. If the target company has extra cash sitting on its balance sheet, that cash can often be used to help pay for the deal itself. When that happens, "Target's Excess Cash" becomes a Source of funds, reducing the new money the buyer has to raise.

Incorrectly Calculating the Equity Purchase Price Remember, the key "Use" is the price paid for the target's equity, not its enterprise value. You're paying off the shareholders. The target's existing debt is a separate issue—you'll refinance it, which shows up as another "Use" on the table. Don't mix them up.

A perfectly balanced sources and uses table is the bedrock of any deal model. If an interviewer sees you miss a line item or fail to balance the two sides, they'll immediately question if you have the attention to detail required for the job.

Getting these details right is what defines professional excellence, whether it's in a financial model or a global supply chain. In fact, by 2025, global sourcing is undergoing its own transformation, with companies now using AI to optimize decisions and mitigate supply chain risks. This ensures their sources of goods are as solid as their sources of funds. You can find more insights on these global sourcing trends on Dragon Sourcing.

Next Steps: Time to Get Your Hands Dirty

Reading about sources and uses is one thing. Actually building the table under pressure is another. The only way to get good at this is to do it.

This is where you bridge the gap between knowing the theory and owning the skill. Moving from just reading to actively solving problems is how you’ll build the muscle memory to crush this in an interview or on the job. Let's make this second nature.

Mini-Case Study Drills

Alright, grab a spreadsheet. It’s time to build a couple of sources and uses tables from scratch. The golden rule? Sources MUST equal Uses. Every time.

Drill 1: An M&A Acquisition

Target Equity Purchase Price: $250 million

Refinance Target's Debt: $80 million

Transaction Fees: $15 million

Financing: New Term Loan of $175 million

Your Task: Figure out the buyer's equity contribution and build the full S&U table.

Drill 2: A Debt Refinancing

Existing Debt to Refinance: $500 million

Financing Fees for New Debt: $10 million

New Debt Issuance: New senior notes totaling $510 million

Your Task: Structure the sources and uses. What’s the real point of this transaction?

Nailing these simple exercises is how you build a foundation for more complex models. The ability to quickly and cleanly map out how a deal gets funded is a skill that separates the top candidates from everyone else.

Digital connectivity has become a critical source for modern economic activity. By October 2025, approximately 6.04 billion people were internet users, representing 73.2% of the global population. This expansion fuels everything from e-commerce to remote capital sourcing, making digital platforms essential. You can explore more about the rise of the global digital population on Statista.

Remember, building the model is only half the battle. You also have to be able to talk through it clearly and confidently. To sharpen that skill, check out our interview skills practice guide for tips on how to articulate complex finance topics when the pressure is on.

Frequently Asked Questions About Sources and Uses

Even after you get the hang of the basics, a few tricky situations always seem to pop up when you're building a sources and uses table. Getting these right is what separates the beginners from the pros.

Let’s walk through a few of the most common curveballs you’ll see in interviews and on the job.

How Should I Treat Cash on the Target Company Balance Sheet?

This is a classic interview question. If a target company is sitting on a pile of cash—more than it needs for its day-to-day operations—the buyer can actually use that money to help fund the deal.

When that happens, "Target's Excess Cash" shows up as a Source of funds. It's like finding a wallet in the pocket of a coat you just bought; that money is now yours, and it reduces the amount of new capital you need to come up with. The deal just got a little cheaper.

Can a Company Use its Own Stock as a Source of Funds?

Absolutely. This happens all the time in stock-for-stock M&A deals. Instead of paying with cash, the acquiring company simply issues new shares of its own stock and gives them to the target's shareholders.

In this scenario, "New Acquirer Stock Issued" is listed as a Source. The matching Use on the other side of the table is the "Purchase of Target Equity." You'll see this a lot in large, public M&A deals where cash might be tight or the acquirer wants to give target shareholders a piece of the new, combined company.

Where Do Transaction Fees Actually Come From?

Transaction and financing fees are always a Use of funds, but it can be a little confusing to think about where the money for them comes from. These are the real cash costs you pay to bankers, lawyers, and consultants for their advice, plus any fees paid to lenders for providing the debt.

Think of it this way: these fees are paid out of the total pool of capital raised for the deal. The sources and uses table forces you to account for everything, ensuring you raise enough money to cover not just the purchase price, but also these critical—and often very large—deal costs.

Ready to master the details that land offers? AskStanley AI provides infinite technical drills, realistic mock interviews, and adaptive learning plans to sharpen your skills. Move from theory to mastery and walk into your interviews with total confidence. Start your journey at https://www.askstanley.ai.